By Alexandre Blein, Thematic Equity Portfolio Manager and Fanny Cutard, Retail Marketing Manager

As an asset manager, CPR AM plays a key role in corporate finance. It is our responsibility to incorporate climate challenges into our analysis of companies as of now, so as to reduce the climate related financial risks of tomorrow.

In order to achieve this, on 7 December 2018, CPR AM launched a new global equity fund, CPR Invest – Climate Action, in partnership with CDP.

Managing climate risks, a fiduciary responsibility

The impacts of climate change can already be seen on the environment, human life, the animal world and biodiversity, yet the consequences are also economic in nature. Between 1998 and 2017, economic losses connected with global warming totalled $2,908 billion, i.e. a rise of 251% compared with the 20 previous years1.

And tomorrow, we will face the financial consequences. We believe that it is essential for companies to take account of climate issues for their profitability and that climate risk is not currently reflected in their market valuation.

CPR Invest – Climate Action’s goal is to reduce the climate risk of our investments for our clients, by supporting companies committed to a process of environmental transition.

CDP as an NGO with the largest database on climate issues and supported by major institutional investors around the world, is the preferred partner for managing the fund’s climate risk.

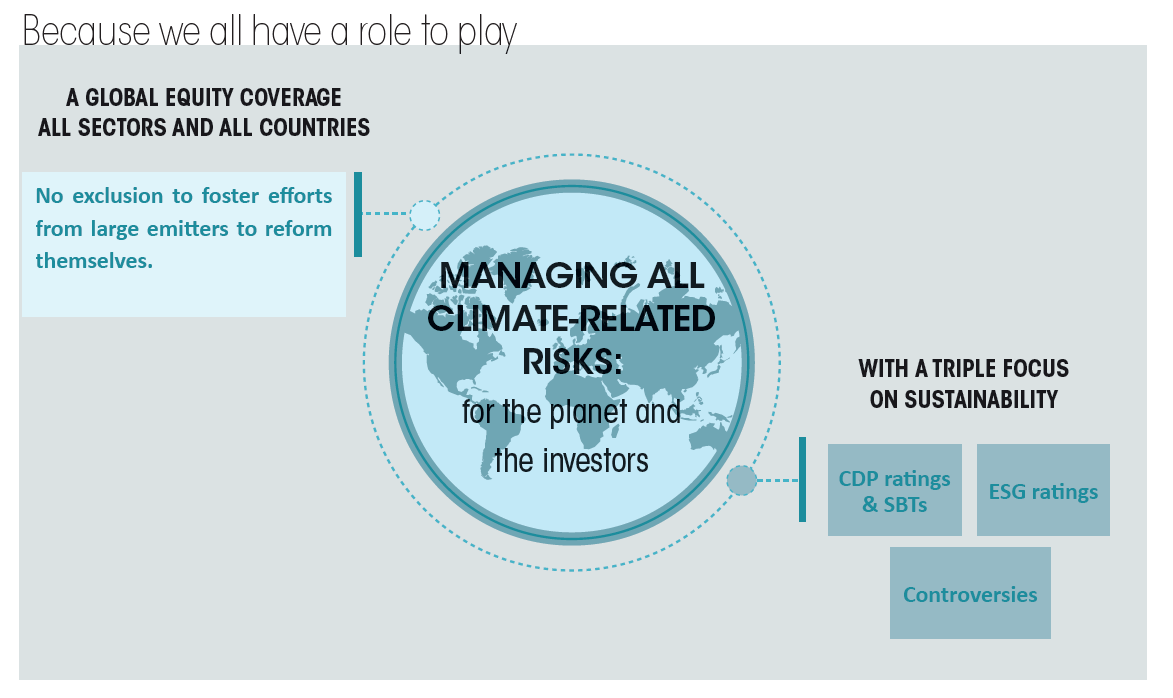

CPR Invest – Climate Action is a global equity fund. Compared with the traditional thematic management approach employed at CPR AM, the universe includes the companies most committed to an energy and ecological transition process, whatever their sector of activity. For we believe that all economic stakeholders must act to reduce their greenhouse gas emissions and reverse the energy mix towards the decarbonisation of energy consumption.

A responsible and robust investment method

In order to achieve this, we use the method and ratings provided by CDP, alongside our thematic responsible approach:

1/ selection of the most advanced companies in the management of climate-related risks (A and B on a scale from A to D) according to the CDP ratings;

2/ exclusion of companies with the worst Environmental, Social and Governance (E, S, G) behaviours according to ratings provided by our internal ESG analysis team: considering the average ESG ratings, ratings of Environmental and Governance components, and, lastly, all ratings relative to each of the environmental criteria;

3/ a filter for the worst ESG controversies.

Moreover, we reintegrate companies who set themselves ‘Science-Based’ objectives through the SBT² initiative, if, and only if, their CDP score is equal to or greater than C.

Active management in a universe with a reduced climate risk profile

Our eligible universe is made up of around 700 stocks. The classic investment process is then applied with a double quantitative evaluation, which makes it possible to reduce the fundamental analysis to 150 stocks. The final portfolio is then made up of 60 to 80 companies with the best financial, climate and extra-financial profiles.

The portfolio is currently made up of approximately 70 stocks. It reflects regional dynamics on climate issues and the sectoral and geographical convictions of the management team. European and Japanese stocks are thus overweighted and American stocks underweighted, while no sectoral bias has appeared to date.

A commitment built on transparency

Specific reports will be provided to ensure detailed monitoring of the construction of the eligible universe (monitoring of exclusions by filtering) and the portfolio’s ‘carbon’ data (carbon emissions and reserves, geographical and sectoral contributions of emissions, coal and green technology exposures, etc.).

Moreover, we work actively on data linked to the 2°C target set by companies, in order to offer a comparison between the portfolio and its index, and thus provide a strong indication for our clients’ investments.

Lastly, an Early Bird share class is dedicated to the first investors who wish to back the launch of the fund during its first year (or within the limit of assets of EUR 100 million managed in the fund).