Catherine Crozat, Quantitative Research Analyst and Tegwen Le Berthe, Equity Investment Specialist and Head of ESG development at CPR AM

Companies, which are responsible for close to 70% of global CO2 emissions, are exposed to climate related risks that will affect their financial valuations. These risks are related both to the transition to a lower-carbon economy and to the physical impacts of climate change.

To identify and mitigate the potential financial effects of climate change and take advantage of the associated opportunities, investors need more environmental metrics and information about companies. As a pioneer in carbon disclosure and a key TCFD-aligned initiative in environmental data disclosure, CDP helps investors get access to this information. CPR AM signed an exclusive partnership with CDP in order to offer to its clients an advanced expert solution to manage climate related risks.

CDP has built the largest environmental database

CDP (formerly known as Carbon Disclosure Project) is a global environmental impact non-profit organisation, providing a platform for all companies, cities, states and regions to report on their climate, water and deforestation impacts. CDP was founded in 2000 with the ambition of making environmental reporting and risk management a new business norm. CDP requests information about climate risks and low carbon opportunities from the world’s largest companies on behalf of investor signatories and big purchasers, and transforms that data into detailed analysis on critical environmental risks, opportunities and impacts.

In 2018, over 650 investors controlling USD 87 trillion in assets signed CDP’s annual disclosure request.

When CDP launched the concept of environmental disclosure in 2002, only 35 investors had signed its request for climate information and 245 companies had responded. Over the past 15 years, CDP has created a system that has resulted in unparalleled engagement on environmental issues.

In 2018, over 7,000 companies representing over 50% of global market capitalization disclosed environmental data through CDP.

CDP was ranked as the top climate research house in 2015, 2016 and 2017 (Extel IRRI), and won ‘Best ESG / SRI Research’ at the 2016 and 2017 Investment Week awards.

CDP is also the co-founder of the Science-based Targets (SBT) initiative, partnering with the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). The initiative establishes the methodologies for companies to set ambitious targets in line with the level of decarbonisation required to limit global warming in line with the goals of the Paris Agreement (see box page 4).

A sector focused disclosure, aligned with TCFD since 2018

The purpose of CDP is to drive change, and incentivize actions and transparency. Scoring is an important element of CDP’s mission, motivating companies to disclose their impacts on the environment and on natural resources and to take action to reduce negative impacts.

In 2018, CDP updated its questionnaires to take a sector-focused approach and to align with TCFD1. The Task Force on Climate-related Financial Disclosures (TCFD) of the Financial Stability Board is garnering increasing support, with 513 firms now endorsing the recommendations.

Under this new approach, each of CDP’s questionnaires (Climate Change, Water and Forests) has general questi ons alongside sector-specifi c questi ons aimed at high-impact sectors. The 2018 questi onnaire includes roughly 150 questions divided in 14 modules: Governance, Business Strategy/Risk Management, Targets and Performance, Metrics (emissions, energy, other, etc.), Carbon Pricing, Engagement, Land Management… Through an upgraded environmental disclosure platform, the 7,000 companies disclosing in 2018 aligned their disclosures with TCFD’s recommendations. Preliminary analysis showed that 72% of listed companies were able to answer 21 or more of the 25 new TCFD questions on the CDP platform.

CDP scoring: The steps to follow for quality environmental management

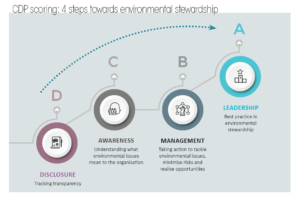

The scoring methodology is a means to assess a company’s progress towards environmental stewardship as communicated through its CDP response. The evaluati on methodology ultimately yields a score ranging from A to D (with A awarded to companies with best practices).

As well as environmental measurement and accounti ng, the scoring looks at the ways in which companies assess a broad range of climate change risks and impacts and then go on to put policy, strategy and governance in place to manage those risks and impacts.

Because of the need to represent a broad range of maturity levels and to allow for the methodology to keep pace with the development of environmental stewardship best practice, CDP score the questionnaire across 4 consecutive levels:

Each level has a different emphasis: completeness at the Disclosure level, basic knowledge at the Awareness level, action at the Management level and best practice at the Leadership level.

A minimum score and/or the presence of a minimum number of indicators at one level is required in order to be assessed at the next level. If the minimum score threshold is not achieved, the company will not be scored at the next level.

The four levels represent the steps on a company’s journey to becoming a good environmental steward. Scoring is both independent and influential; it is carried out by partner organisations trained by CDP and subjected to rigorous quality assurance checks.

CDP, underpins the environmental data used by the market

CDP’s database represents the largest global repository of risk commodity information relating to climate change, water and forests, making the platform one of the richest sources of information about how companies and cities, states and regions are driving environmental change. Sectorfocused disclosure, forward-looking metrics and scoring empower investors to undertake strategic engagement and to take portfolio allocation decisions.

For companies, this increases their awareness of potential issues and opportunities and helps forge a pathway for action. It also builds up a picture of what progress is being made, and makes it easy to track which actions have had the greatest impact, while enabling better peer-to-peer benchmarking.

Therefore, CDP is providing companies and investors with meaningful and comparable data to drive greater progress. Therefore, CDP is providing companies and investors with meaningful and comparable data to drive greater progress.

CDP underpins the environmental data used by the market by providing other organisations and companies that provide their own research, data products, indices and ratings.

CDP data is also already powering financial products index families for instance the STOXX Low Carbon Indices and the New York State Common Retirement Fund’s low carbon index. It enables market participants to limit the exposure of their portfolios to carbon risk through a passive management.

CPR AM is the first asset manager to offer an actively managed investment solution based on both CDP and SBT scores. Thanks to an exclusive partnership, CDP and CPR AM are proud to launch an innovative solution that combines environmental data disclosure with a demanding financial and extra-financial investment process.

In December 2018, CPR Asset Management has become the first asset manager to license climate rating Climetrics to market its funds. Developed by international non-profit and climate specialists, CDP and ISS-climate, Climetrics gives investors a holistic assessment of a fund’s climate-related risks and opportunities. The independent rating allows investors to assess the long-term impact of their investments and to ensure they are well-positioned in the transition to a low-carbon economy.

About Science-Based Targets (SBTs)

Science-based targets provide companies with a clearly-defined pathway for aligning their strategies with the goals of the Paris Agreement, the international accord signed by 195 nations to limit global warming to well below 2°C above preindustrial levels and pursue efforts to limit warming to 1.5°C.

Companies are increasingly adopting SBTs: as of 31 December, 2018, 505 companies had committed to set a science-based target (compared to 326 in December 2017) and 163 of them have had their target approved (compared to 84 in December 2017).