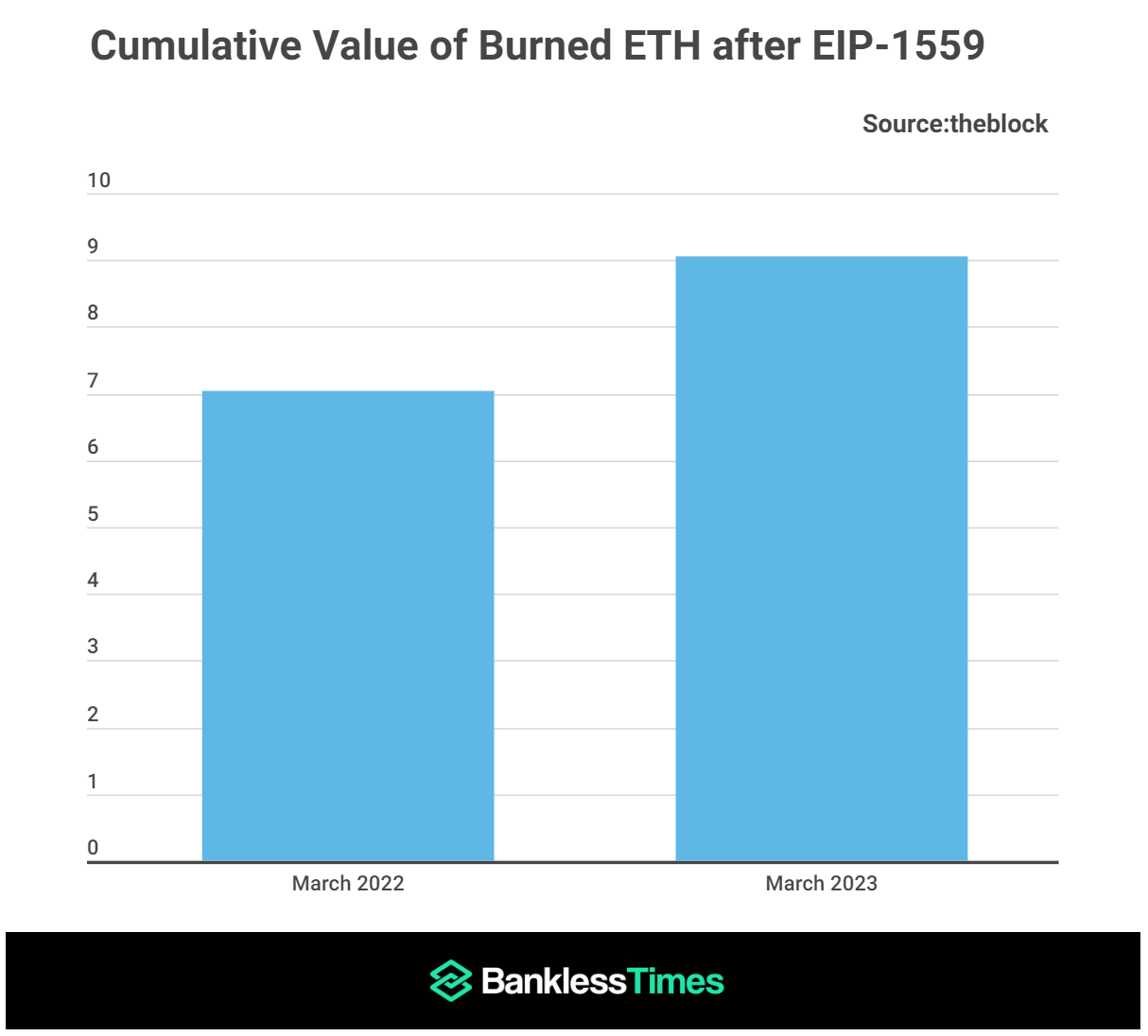

- Ethereum has burned over 6.5 million ETH worth $9 billion since EIP-1559.

- EIP-1559 is an upgrade aimed at reducing high transaction fees and gas prices.

- Ethereum burning has a deflationary effect and reduces the overall supply of ETH.

Ethereum is quickly becoming one of the world’s biggest and most powerful blockchains, and this new burning efficiency could be part of what makes it truly unstoppable. According to BanklessTimes.com, Ethereum has burned over $9 billion worth of Ether (ETH) since the EIP 1559 in August 2021.

EIP-1559 was a highly anticipated upgrade to Ethereum that aimed to address the issue of high transaction fees and improve the user experience of the platform. One critical feature of the EIP-1559 was introducing a new fee structure that involved burning a portion of transaction fees.

Jonathan Merry, the CEO of BanklessTimes, commented on the data:

Ethereum has been on a journey of scalability and sustainability. The burning of over $9 billion worth of ETH since EIP-1559 is a significant milestone towards that. Reducing the supply of ETH and creating a predictable fee market will benefit users in many ways. Besides, it will make the network more accessible and affordable

BanklessTimes, CEO Jonathan Merry

Ethereum’s Deflation Hits Unprecedented Levels

Recently, the deflation rate of Ether hit its peak this year. On Wednesday, it surpassed the current Ethereum Issuance Rate by a whopping 1.425%, which marks its highest level since last May when there was an anomaly where it surged to 17% for one day only.

The burn rate of ETH, which is the rate at which Ether is destroyed when transactions are processed, has also been steadily rising since EIP-1559 was implemented. This has led to a decrease in the overall supply of ETH and an increase in its value.

The reduction in the overall ETH supply has pushed its deflation rate to nearly 6%, which is the highest it has been in years. This means that Ethereum users are now experiencing one of the most efficient burning records ever seen in crypto.

Financial Policy of the Ethereum Network

In a significant sense, EIP-1559 has changed the monetary policy of the Ethereum network. Before, miners received all transaction fees as a reward for validating and adding transactions to the blockchain. With EIP-1559, part of the base fee is now burned, reducing the overall supply of Ethereum. This has the effect of making Ethereum a deflationary asset, with the supply decreasing over time.

The burning mechanism also implies that more ETH is being destroyed than the quantity issued to miners. As a result, the growth rate of supply has now dropped to a negative 1.06% per year since the implementation of EIP 1559.