ECB preview: pushing back on higher yields

At the September meeting the ECB announced that PEPP purchases would be slowed modestly, and revised to the upside its inflation and growth outlook. Since then, global markets seem to have started repricing a more hawkish approach to monetary policy for major central banks: a BoE hike in November this year, and the Fed is seen raising rates for the first time in September 2022. As a result, global financing conditions have tightened substantially and also in Europe: the European 10Y GDP-weighted average yield has risen by almost 20bp since the ECB’s September meeting, while money markets have started pricing in the first ECB hike in September 2022 with a 90% probability.

We think that the ECB will leave its monetary policy unchanged at its October meeting, but will adjust its language in order to push back against the recent tightening in financing conditions, which we believe the ECB will view as unwarranted.

We think the ECB will maintain its language on the inflation outlook: while risks remain marginally tilted to the upside, we expect the ECB to reiterate that the Governing Council sees the recent rise in inflation as transitory.

We don’t expect to hear much on the future of the PEPP and APP until the December meeting. We maintain our view that the ECB will end its PEPP in March 2022, but expand the APP by more than the consensus envisages: fixed monthly purchases up to €40bn per month, plus a temporary €140bn APP envelope, all to be announced in December.

At its September meeting the ECB announced it would slow the pace of its PEPP purchases (see more in our ECB review, 9 September 2021 ) , and adjusted its language concerning PEPP purchases from a “significantly higher pace than during the first months of the year” to a “moderately lower pace…than in the previous two quarters”.

Between March and July of this year the ECB bought an average of around €19bn per week underPEPP, totalling around €80bn per month (we exclude the month of August from our calculations, due to extremely low purchases, in turn due to the low market liquidity in the summer). We believe the new language implemented by the Governing Council in September signals that the ECB will be moving from around €80bn per month in PEPP purchases to around €70bn per month following September’s decision. As Figure 1 shows, the ECB’s purchases have slowed over the past few weeks, to an average pace of around €17.5bn per week.

However, since September’s decision, financing conditions have changed substantially. European long sovereign yields have risen materially, with the 10Y GDP-weighted average yield up by almost 20bp since September 9 (Figure 2), while money markets have started pricing in the first ECB hike in September 2022 with a 90% probability (Figure 3). We suspect the ECB will push back on these recent market moves at its October meeting, viewing the rise in market yields as an unwarranted tightening in financing conditions. We also think the ECB will continue to see the current rise in inflation as transitory, and highlight how its medium-term inflation forecasts remain well short of the ECB’s target.

The ECB’s Chief Economist Philip Lane spoke this week at the Bank of Finland and SUERF joint conference, clarifying the inconsistency between the ECB’s forward guidance and current market pricing: “If you look at market pricing of the forward interest rate curve, I think it’s challenging to reconcile some of the market views with our pretty clear rate forward guidance…Various Governing Council members have been indicating [that] markets may not have fully absorbed rate forward guidance”.

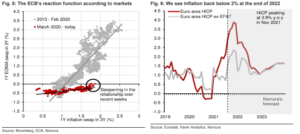

Since July, when the ECB published its new inflation target and new forward guidance, we found a clear twist in the ECB’s monetary policy towards being more dovish. According to a speech from the ECB’s Isabel Schnabel on 15 September, markets clearly understood over the course of 2020 and 2021 the new ECB’s reaction function. Ms Schnabel showed how the relationship between inflation expectations and market yields has flattened since the start of the pandemic (Figure 5). The combination of COVID-19, a higher inflation target and more demanding rates’ forward guidance call for a more patient ECB. This is especially true at a time when short-term inflation is rising, but medium-term inflation forecasts remain well short of the ECB’s 2% target.

However, the relationship described by Ms Schnabel has started steepening again since mid-September, after having flattened substantially since March 2020. This could be reconciled as follows:

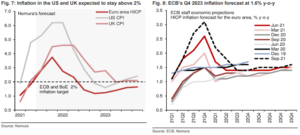

Market participants may fear that inflation will prove stickier than the ECB does. We think inflation will return to rates well below the ECB’s target by the end of 2022, and remain below 2% until the end of 2023 (Figure 6). This is in line with most economists’ expectations, as well as with that of the ECB. However, as inflation continues to surprise on the upside and supply chain disruptions intensify, markets might believe that higher inflation today could ultimately lead to second-round effects that will keep inflation elevated for longer.

Recent market moves in the euro area are almost certainly – in part – the product of contagion from US and UK markets, where both central banks have recently intensified discussions on monetary policy tightening.

We do not expect the ECB to justify the market repricing of the central bank’s reaction function, and thus at its October meeting we think it will strongly push-back on the possibility of an ECB rate hike as soon as 2022.

Could the ECB hike rates as soon as 2022?

Global markets seem to have started repricing a more hawkish approach to monetary policy in recent weeks, with expectations for a BoE hike at its November MPC meeting, and the Fed seen raising rates for the first time in September 2022. However, in our view, the ECB is at a completely different stage of the economic cycle compared with the UK and the US, and the ECB has to deal with a very different medium-term inflation profile than the Fed and BoE, which both see their inflation mandate fulfilled at the end of their forecast horizon (see Nomura’s forecasts in Figure 7). Keeping that in mind, we suspect that the ECB will adopt a fairly dovish stance compared with other major developed economies central banks in the coming months.

According to the ECB’s current rates forward guidance, the central bank would only sanction a mid-2022 hike if its inflation forecasts for 2023 and 2024 both were at or above the 2% mark, with substantial progress in underlying inflation being made at the time of hiking. Also, assuming no change to the sequencing specified in the ECB’s forward guidance, the ECB intends to hike only (shortly) after the end of its APP. A September 2022 hike would not only require the PEPP to end by March 2022, but more importantly the APP to be terminated by around the middle of next year. This scenario seems extremely unlikely to us, based on both our own and the ECB’s inflation forecast (Figure 8), as well as on comments from many ECB Governing Council members over recent weeks.

The ECB could, of course, change its APP forward guidance in order to de-anchor rate hikes from the termination of asset purchases. After all, the Bank of England in its recent communications has warned that rate hikes might happen before the end of its asset purchase programme. The ECB’s current guidance makes the sequencing of the ECB’s eventual policy tightening very clear: the end of APP purchases first and rate hikes thereafter. The ECB could implement a different form of calendar-based guidance for APP, or link APP guidance directly to its inflation target, and thereby decouple APP guidance from that of rates (something that has already been suggested by the ECB’s Centeno ) . However, even under those circumstances, the substance of the issue does not change: the euro area inflation outlook will remain, in our view, incompatible with a 2022 rate hike under the current forward guidance.

The outlook for the APP and PEPP

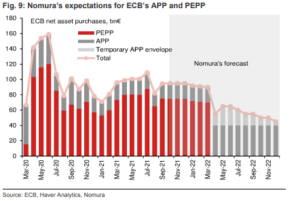

Ahead of the October meeting, we maintain our view that the ECB will announce the end of its PEPP in December 2021. We expect the ECB to use its PEPP envelope in full — on our expectations, it should be exhausted by the end of March. By contrast, we think that the ECB will increase the pace of its APP purchases from €20bn per month to €40bn per month in December 2021. We expect it to implement higher purchases from the start of Q2 2022, when the PEPP will come to an end.

In line with our view that the ECB will maintain a dovish stance in coming months, we think the ECB will deliver an additional APP envelope in December to be used flexibly throughout 2022 depending on financing conditions. With other major central banks undergoing monetary policy tightening in 2022, we think the ECB will want to reserve the optionality to buy more if needed and flexibly over time in 2022, to counteract any spillover effects from markets overseas and prevent any unwarranted tightening in financing conditions.

Fig. 9: Nomura’s expectations for ECB’s APP and PEPP

A summary of the ECB’s policy settings and Nomura forecasts

Interest rates

Rates: Main refining operations (MRO) rate 0.00%, marginal lending facility (MLF) rate 0.25%, deposit facility (DF) rate -0.50%.

Guidance: Present or lower levels expected until inflation has reached 2% well before the end of the projection horizon and durably so. There needs to be “realised progress” in underlying inflation consistent with its aim. Achieving this may mean a transitory period of moderately above target inflation.

Nomura view : We see no rate cuts or hikes over our forecast horizon (to end 2023).

Asset purchase programme (APP)

Amount: Net monthly purchases of €20bn.

Guidance: Monthly purchases to run as long as necessary, ending shortly before key rates are raised.

Reinvestments: In full for an extended period after the first rate hike.

Nomura view : We expect the APP to continue until well beyond the end of our 2022 forecast horizon, and for the ECB to announce at the December 2021 meeting a step- up in the pace to €40bn from April next year. We expect the ECB to announce a € 140bn temporary APP envelope to be used from the start of April 2022 to the end of 2022. APP reinvestments are likely to continue for a period long beyond the first rate hike, as the ECB’s current guidance suggests.

Pandemic Emergency Purchase Programme (PEPP)

Amount: Envelope of €1.85trn.

Guidance: Conducted flexibly across time, asset class and jurisdiction. Purchases to continue until at least end-March 2022. An envelope not a target: “the envelope need not be used in full” if favourable financing conditions can be maintained with lower asset purchases, while the PEPP could equally be “recalibrated” (i.e. enlarged) if financing conditions and the inflation outlook require it. ECB expects purchases to be conducted at a “moderately lower pace of net asset purchases under the PEPP than in the previous two quarters” during Q4 2021.

Reinvestments: Maturing principal reinvested until at least end-2023. Roll-off managed to avoid interference with the appropriate monetary policy stance.

Nomura view : We expect the ECB to purchase at around €70bn per month in Q4 2021. That implies purchases slowing from €20bn per week to something closer to the average of net purchases conducted so far in 2021 (€16.6bn per week). We expect the PEPP envelope to be used in full by spring next year. We do not expect an expansion of the PEPP envelope or PEPP reinvestments to be scaled back until well beyond the end of our forecast horizon.

TLTRO III

Operations : 10 long-term targeted refinancing operations, quarterly from September 2019 to December 2021, each with 3-year maturities.

Interest rates: 50bp below MRO rate (if lending targets not met) or 50bp below the DF rate (if lending targets are met) until June 2022.

Size: 55% of eligible loans.

Usage: Currently €2,208bn outstanding.

Nomura view : TLTROs are now a permanent feature of the ECB’s toolkit and are likely to continue to be offered following the completion of the last TLTRO III in December this year, assuming that inflation continues to undershoot its target and/or pandemic-related concerns remain.

FX strategy: EUR/USD a balancing act

This is why we remain short EUR/USD: We remain short EUR/USD in spot . A lot of the good news for the euro area has already materialised and it will be difficult for EUR to outperform in Q4 2021, with the ECB notably more dovish than the BoE and Fed. We’re running out of reasons for a growth positive to materialise and boost EUR. Perhaps the Fed will reverse course on tapering, talk down US rates pricing at the front end or China significantly eases fiscal/credit policies. Instead, the rise in energy costs and a dovish ECB risks inflation expectations rising in the euro area, dragging real yields down with it. The main risks are 1) if the ECB actually signalled the possibility of rate hikes next year it would likely trigger large position reductions and 2) if the current strength in CNH continues it is likely to be hard for EUR not to rally.

EUR observations:

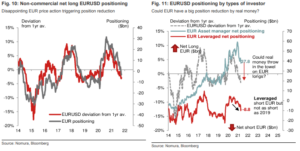

EUR positioning is not stretched. On a non-commercial basis net long positions stand at USD2.7bn. Leveraged accounts make up most of this with -USD8.8bn net shorts. But it’s the real money positioning that stands out to us, and we believe the long-held legacy positions in long EUR/USD ($37.8bn) are finally being unwound at the 1.16 level. It’s a flow that might cap any EUR gains.

Front-end rates moves have stopped moving FX. US rates were the large driver of price action, but that has broken down.

Watch out for moves in CNH: Our Asia FX strategy team expects continued strength in CNH with the market looking for 6.35 and 6.30 as the next levels on USD/CNH after the break of 6.40. This may keep EUR supported, as it translates through to broad USD weakness, as we saw yesterday. But we would note the rally in EUR when CNH was rising was rather limited.