Despite concerns prompted by flattening within the U.S. Treasury yield curve, the U.S. economy looks to have ended 2018 on an upbeat note – at least from the point of view of job-seekers.

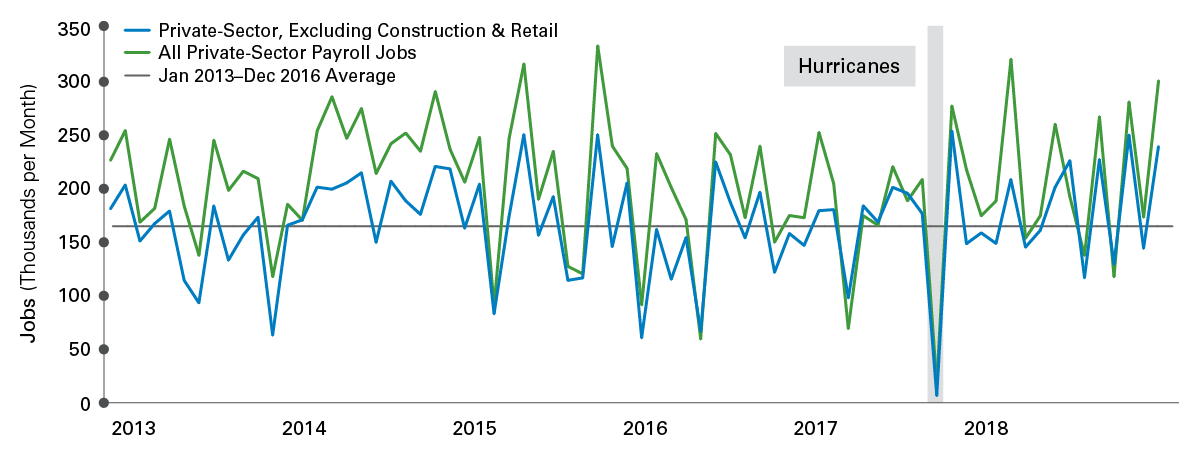

December private-sector hiring came in strongly above expectations at a seasonally-adjusted 301k after an upwardly-revised 173k for November. Factoring out the volatile construction and retail sectors, the rise was 239k for December – still strongly above trend for the past five years.

Seller’s Market: December’s Private-Sector Hiring Continued Strong

Chart courtesy of Western Asset Management. Source: Bureau of Labor Statistics as of 12/31/2018. Past performance is no guarantee of future results. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

These figures suggest the U.S. economy isn’t yet primed to roll over in the face of tariff uncertainty and political stalemates. In fact, reassuring language in recent Fed speeches may suggest that we’re in for a soft-landing resumption of on-trend growth rather than a slide into recession.

As for the shape of the yield curve, the segment between 1- and 3-year maturities now appears inverted. However, the curve retains its positive slope from that point all the way up to the 30-year, whose yield appears to be rebounding, crossing 3.0% to the upside as of January 9, 2019. The significance of a concavity on the shorter-end, if any, has not yet leaked into popular discourse.

On the rise: Emerging Market Debt

Investors in EM debt had a painful 2018, but the rapid turnaround in performance since late November 2018 seems to have legs. The news has been particularly good for U.S. dollar investors in U.S. dollar-denominated EM debt; the Bloomberg Barclays EM US Dollar Aggregate Index rose 2.98% between November 27, 2018 and January 7 of this year. Investors in overall hard-currency EM debt had similar results, for the same period, of 2.86%. But the best performance for U.S. dollar investors was turned in by EM local-currency government debt. Since its low on September 6, 2018, the related index1 rose 6.85% for the period ended January 7, 2018.

Yields for these categories are particularly strong. The U.S. dollar index showed a 5.94% yield-to-worst (YTW) as of January 7; the hard-currency index showed a 5.46% YTW as of the same date; the local-currency government index YTW came in at 4.93%. Of course, these head-turning numbers are admittedly for very short-term intervals and capture data from interim lows. Nonetheless, they seem to suggest that attention should be paid.

On the slide: World Bank Projections for global growth

Under a gloomy photo and the headline “Storm Clouds are Brewing For the Global Economy”, the World Bank lowered its estimates and forecasts for global economic growth by -0.1% to 2.9% and 2.8% for 2019 and 2020. For growth in Emerging Markets and Developing Economies (EMDE)2, the reductions were ‑0.3, -0.5, and -0.2 percentage points for 2018, 2019 and 2020 respectively.

The changes appear small, but the warnings were dire, including talk of loss of momentum, increasing downside risks, trade tensions and growing levels of debt. World Bank estimates are taken seriously by economists and governments alike and can create their own reality of reductions of lending, commodity prices and government policies.

But readers should keep in mind that the headline growth figures for the EMDE group, even after the downgrade, still remain at 4.2% and 4.5% for 2019 and 2020 respectively. Which is nobody’s definition of global recession.