Kishida policies to boost wages and share prices by sector

Uncertain whether policies will prove effective but higher wages a boon for domestic demand-related companies

New tax scheme to encourage higher wages is flagship policy of Kishida’s new capitalism

Prime Minister Fumio Kishida has been increasingly talking about increasing wages as a means of addressing income inequality since he took over the reins. With the administration having decided to put off hiking taxes on financial income any time soon, the tax scheme designed to give preferential treatment to companies that have increased wages now looks like the flagship policy of the so-called new capitalism being touted by the Kishida administration.

Impact of existing wage hike tax scheme likely to be limited

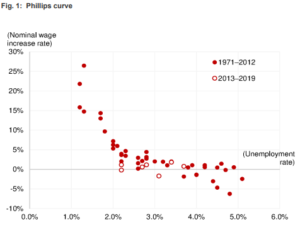

The Shinzo Abe government introduced a scheme to encourage wage hikes via cuts to corporation tax in FY13. It was revised in FY18 to include not only wage increases but also capex and staff training as conditions, and it is still in place. The Kishida administration appears to be considering moves to bolster this scheme, but without substantial changes we think its effectiveness will prove limited. First, the Phillips curve shows a stable correlation between the rates of unemployment and rates of wage increases over the long term, and we see no evidence that the tax scheme introduced in FY13 has encouraged higher pay (Figure 1 ). There has been no change from the historical trend of companies adjusting wages based on labor supply-demand conditions, and from a macroeconomic basis at least we see corporation tax cuts have had only a limited impact on wage increases. Second, there has been no increase in usage of the tax scheme among companies. According to the Ministry of Finance, the number of companies using the scheme remained on an uptrend from its introduction in FY13 through to FY17 but has been flat since then.

Higher wages a positive for domestic demand sectors and airlines

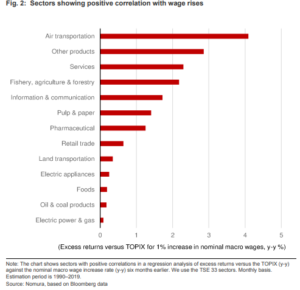

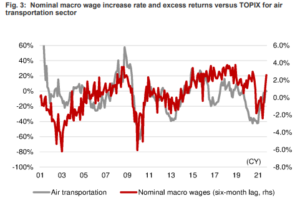

The Kishida administration has yet to flesh out its tax scheme aimed at encouraging higher wages, making it difficult to gauge its effectiveness. That said, we think it useful to envision the sector implications should it prove successful. For companies, higher wages directly lower corporate earnings via higher employment costs but indirectly boost corporate earnings, particularly among domestic demand-related companies, by improving household purchasing power. To gauge the impact of both factors on share prices, we plotted sensitivity of the TSE-33 sectors to the nominal macro wage increase rate. Sectors with positive sensitivity are primarily domestic demand sectors that readily benefit from increased consumer spending in Japan (Figure 2 ). The chart also shows air transportation as the likely biggest beneficiary of wage increases, and this relationship has also been stable over time (Figure 3 ). Airline stocks are currently being affected by a recovery in passenger demand on the one hand and rising fuel costs on the other, but we think the Kishida administration’s new tax scheme will warrant attention as a gauge to future performance.

Note: Nominal wage increase rate is for total cash earnings at businesses with at least 30 employees. Source: Nomura, based on Ministry of Internal Affairs and Communications, Ministry of Health, Labour and Welfare data

Note: The chart shows sectors with positive correlations in a regression analysis of excess returns versus the TOPIX (y-y) against the nominal macro wage increase rate (y-y) six months earlier. We use the TSE 33 sectors. Monthly basis. Estimation period is 1990–2019. Source: Nomura, based on Bloomberg data

Note: Both nominal macro wage increase rate and excess returns versus the TOPIX are y-y. As of 15 October 2021. Source: Nomura, based on Ministry of Internal Affairs and Communications and Bloomberg data