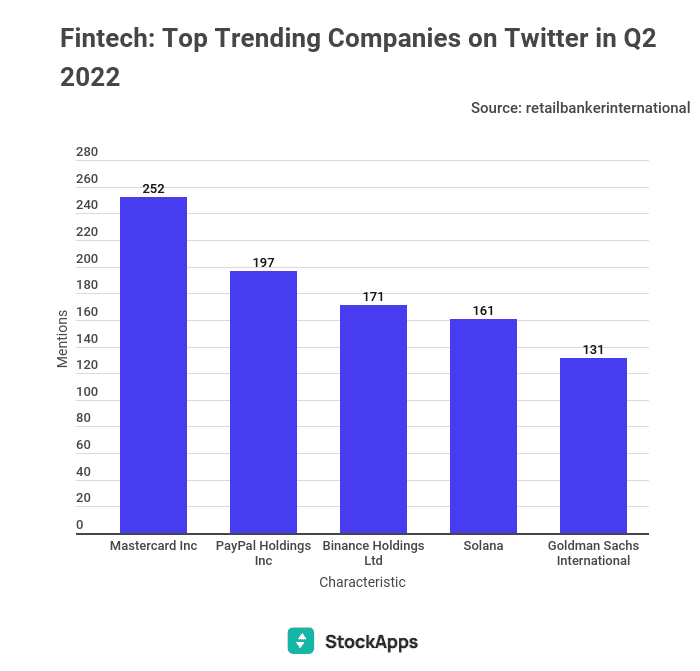

Twitter is a big deal! People give information, share ideas, and endorse products. Fintechs have been growing fast, and most people have taken discussions to Twitter. According to StockApps.com, MasterCard is Q2 2022, the most influential Fintech Company on Twitter, with 252 mentions.

Paypal holdings, the second most influential fintech, had 197 mentions. With Binance holding taking the third spot with 171 mentions.

Commenting on the data, StockApps.com analyst, Edith Reads, said. “The most discussed topics in Q2 involved MasterCard’s 15 trademark filings related to the metaverse and NFTs. Besides, the firm’s innovative biometric payments that made shopping more convenient also featured.”

She went on to say that trending online doesn’t mean validation. “A product can trend online for all the wrong reasons. It doesn’t mean people only mention them for their performance. However, publicity is publicity, and it counts. MasterCard’s discussion was progressive.”

Social Media Is Critical for Fintech

Most clients, especially those using fintech, desire a quick and straightforward experience. Brands in FinTech are at the center of a digitally oriented cultural transformation. Most firms embark on Social media for advertisements. They use the media to show how comprehensive they offer financial services.

Besides, brands in the FinTech industry are using social media to track their client’s happiness and boost it. Social media amplifies clients’ opinions and gripes in today’s interconnected global culture.

Leading fintech firms like MasterCard and PayPal use social media as a live and interactive platform. Besides, they gauge their products and services efficacy, usefulness, and popularity via social media.

Clients, especially unhappy ones, who tweet directly to FinTech firms’ @handles or #hashtags usually get a reply faster.

Mastercard Is Making Moves

Mastercard agreed with cryptocurrency intelligence startup CipherTrace to get its business. Cipher controls more than 900 different cryptos. Thus, improving the capabilities of MasterCard in the realm of digital assets.

CipherTrace creates techs that contribute to the elimination of illegal transactions involving digital assets.

Chainalysis and Elliptic are considered to be the company’s most significant rivals.

After MasterCard completes this acquisition, its enterprise clients using CypherTrace will enjoy access to analytics and consultancy on crypto-related topics. This would assist in recognizing and comprehending the danger