Par César Pérez Ruiz – Head of Investments & CIO – PICTET Wealth Management

| – US jobs data surprises – Central banks show support – Equities off to rocky start |

||

A KANGAROO MARKET WEEK

The first week of the year delivered a series of conflicting signals and a complementary dose of volatility in markets. After 20 days of daily moves of over +/-2% in the S&P 500 in 2018, out of last week’s three trading days of 2019 alone, two were marked by daily moves of over +/-2%. In data, the December US ISM manufacturing index showed its weakest reading in two years, as businesses continue to worry about trade tensions. However, this was countered by good news on Friday when a report from the US delivered a positive surprise, with December posting the strongest jobs growth in 10 months as wage growth accelerated.

Company news was also mixed. Apple dominated headlines and sent ripples through global markets after cutting its fourth quarter sales forecasts on the back of slowing demand in China and falling new iPhone sales. Shares in Apple dropped, bringing other big tech players along with it, especially the chipmakers that make iPhone components. In the same week, US-based Bristol-Myers Squibb struck one of the largest deals in the history of pharmaceutical M&A after agreeing to buy its rival Celgene in a cash and stock deal worth USD 90bn. The kangaroo has come bouncing through markets in full force as we kick off 2019, and we will keep a close eye on the corporate reporting season, as earnings forecasts have started to come down.

Meanwhile, the central banks of the US and China have shown that they are ready and able to sooth and support markets. At the end of a week dominated by fears about the Chinese slowdown, the People’s Bank of China announced a USD 117bn stimulus measure by cutting the share of deposits commercial banks are required to hold in reserve. By a similar token, US Federal Reserve chairman Jerome Powell promised patience on rate rises on Friday despite continued positive economic data. Global markets gave a sigh of relief and equities regained some ground. However, while there is reassurance that the central banks of the world’s two largest economies still have stimulus levers at their disposal, the European Central Bank has very little it can do should markets require its support. In all, the start to the new year has proved supportive of our cautiously optimistic outlook for 2019.

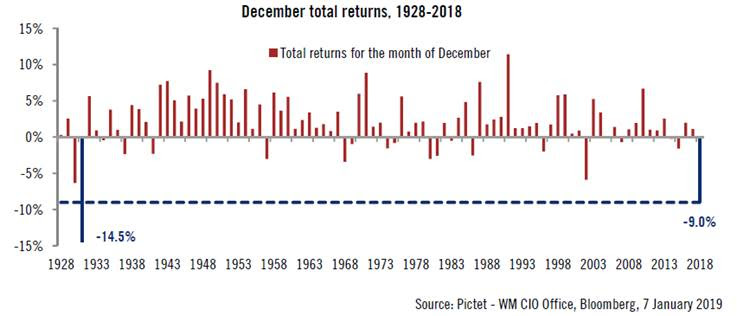

CHART OF THE WEEK: NO YEAR-END RALLY IN DECEMBER

Last month saw the worst December performance for the S&P 500 index since 1931. And a positive total return of 2.89% (in USD)1 in the last week of the year was not enough to prevent December from being the worst month in 2018 either. Investor hopes for a year-end rally were dashed by the more hawkish-than-expected tone adopted by Fed chairman Jerome Powell. Geopolitical concerns and algorithms amplified the market drop.

MACROECONOMY: US REPORTS JOB CREATION SURGE

Strong December US jobs report

The US economy added 312,000 jobs in December, beating economists’ average

estimate of 180,000. Average hourly earnings rose by 3.2% over the past 12 months,

and December was the third straight month that wage gains exceeded 3% year-over-year. October and November data were revised upward by a combined 58,000 jobs.

French December PMIs worse than previously thought

The composite purchasing manager index (PMI) for France dropped more than previously thought, to 48.7 in December, a steep decline from November’s reading of 55.1. The decline was attributed to weeks of disruption caused by the Yellow Vest protests. New orders declined for the first time in 34 months in December.

China PMIs enter contraction territory

The official Chinese PMIs came in at 49.4 in December, down from 50 in November, signalling contraction in business activity. In response, the People’s Bank of China announced a further reduction in banks’ required reserve ratios. We expect further policy measures ahead, including cuts in corporate and value-added taxes. There may also be further support for infrastructure investment.

MARKETS: EARLY YEAR HIGHS AND LOWS

Barrage of late-week news lifts equities

After a shaky start to the year, due in part to an earnings warning from Apple, US equities ended last week in positive territory thanks to further Chinese efforts to steady the economy, hopes for US-China trade talks, a better-than-expected US jobs report, and comments from Fed chief Jerome Powell that the Fed would be ‘patient’ on rate rises. The S&P 500 posted a gain of 1.90% over the short week (in USD), while the Stoxx Europe 600 rose 2.13% (in euros)2. We believe the recent sell-off in equities, particularly in the US, was excessive in view of still-decent fundamentals, but we fully expect the volatility seen of late to persist.

US yields have a roller-coaster week

The better-than-expected increase in US payrolls, plus the acceleration in wage growth and Powell’s comment that the Fed would be patient about further rate increases, led to a late-week reversal in the decline in US government yields. The two-year yield remained stable at 2.5%, but the 10-year US Treasury yield still fell 5 basis points (bps) over the week, to 2.67%. Echoing equities’ performance, US high yield had a good week. The pessimism that pushed government bonds yields lower and credit spreads wider in recent weeks might prove overdone—but visibility is scarce and we remain underweight US credit.

Market illiquidity propels yen

Market skittishness (and low trading volumes) sparked a short, sharp yen rally, with the US dollar briefly reaching a nine-month low of 105 yen, although the Japanese currency later relinquished some of its gains. Higher rates in the US were always likely to feed into higher market volatility, and therefore put upward pressure on the yen. Offsetting this, and putting a cap on the yen’s rise, is our view that the US will not fall into recession this year and the Bank of Japan’s commitment to ultra-accommodative monetary policy.

INVESTMENT STRATEGY: TIME FOR VALUE CREATION IN REAL ESTATE

Long-term horizon allows for value-added strategies

With capitalisation rates (net operating income to current market value) having compressed, pushing up the price of assets, value-creation strategies are becoming ever more compelling in real estate investing. Value can be added through physically improving a real estate asset, or by improving the asset’s use and operational efficiency, i.e. “sweating” the asset more—for instance, by adapting office space to the needs of modern tech companies or reducing a building’s energy consumption. Private real estate’s long-term investment horizon allows for intrinsic value creation independent of market swings, while at the same time offering downside protection. Tangible assets retain a residual value over time – the “bricks & mortar” component. Even in times of volatility, property will maintain a latent value, more so if the quality of the asset and the location is good.

1 Source: Pictet WM AA&MR, Thomson Reuters. Past performance, S&P 500 Composite (net 12-month return in USD): 2014, 13.7%; 2015, 1.4%; 2016, 12.0%,

2017, 21.8%; 2018, -4.38%.

2 Source: Pictet WM AA&MR, Thomson Reuters. Past performance, Stoxx Europe 600 (net 12-month return in EUR): 2014, 7.2%; 2015, 9.6%; 2016, 1.7%; 2017,

10.6%; 2018, -10.22%.