Anchor Report: India telecoms – On the cusp of growth

Aditya Bansal – NFASL / Anil Sharma – NFASL

Regulatory tailwinds and easing competitive intensity to improve sectoral health; Bharti in a well-hedged

position

Regulatory tailwinds emerging with the shift in GoI’s stance towards telcos. Recent telecom reform measures signal a shift in the Government of India’s (GoI) stance from “Revenue maximization” to a balance between GoI’s revenue maximization and ensuring strong telecom operators for the “public good”. Further, the Union Minister of Communications recently stated that GoI is working on the next set of reforms to unleash the telecom sector’s growth, and would do whatever it takes to ensure telcos have enough resources in their hands to focus on deploying networks to connect remote areas. Competitive intensity to ease with the GoI’s intent to protect 3+1 construct. With the GoI showing its intent to protect the “3+1” telecom market structure, the competitive intensity will likely ease, in our view.

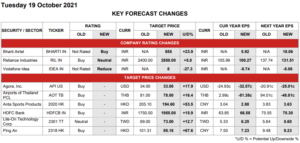

- Bharti Airtel (BHARTI IN, Not Rated→Buy, TP INR 855)

- Vodafone Idea (IDEA IN, Not Rated→Reduce, TP INR 8)

Reliance Industries (RIL IN) (Neutral) – Downgrade to Neutral on limited upside (Buy→Neutral, TP INR 2,400→INR 2,850)

Anil Sharma – NFASL / Aditya Bansal – NFASL

Outlook for key businesses improves; valuations look rich after run-up; downgrade to Neutral, lift TP to

INR2,850

1H was weak; outlook improves for key segments. After a relatively weak 1HFY22 (mainly due to the second wave of COVID-19), we note the outlook for each of the key segments has been improving. In oil to chemicals (O2C), refining margins are up sharply. In E&P, gas prices have been seeing sharp increases. In telecom, recent relief measures have been positive, and subscriber net adds have picked up pace. Although delayed, we think a tariff hike is inevitable. In retail, footfall is normalizing. New energy is the new focus; acquisitions to fast-track investments . In our view, RIL’s recent run (3M, RIL +28%, NIFTY +12%) was, in part, driven by its next big foray into clean/green “new energy”. RIL plans to set up four Giga factories for: 1) integrated solar PV; 2) energy storage; 3) hydrogen; and 4) fuel cell. Solar seems to be its early focus. RIL has acquired REC Solar; it plans to acquire a 40% stake in SWSOLAR (Not Rated) and has bid for 4GW of integrated solar manufacturing under the PLI scheme.

Technology – Chip shortages – TSMC earnings read-through

David Wong, CFA, Ph.D. – NSL / Aaron Jeng, CFA – NITB / Vivian Yang – NITB

Ongoing chip shortages despite new highs in supply indicate genuine demand strength

TSMC (2330 TT, Buy) has reported that in the September quarter in 2021 its wafer output rose 6% q-q. Data from the Semiconductor Industry Association/World Semiconductor Trade Statistics (WSTS) indicates that the three- month rolling average of global semiconductor shipments approached it previous peak in April 2021, and has moved to new highs in each of the subsequent four months reported since then. We think that the persistence of chip shortages in the face of briskly rising supply points to substantial strength in demand in the semiconductor end markets. Higher capex; we expect shortages to be resolved in 2022. TSMC’s capex in the September quarter was NTD189bn, bringing capex for the first three quarters of 2021 to NTD604bn, already more than TSMC’s capex of NTD507bn for the full-year 2020.

Agora, Inc. (API US) (Buy) – Demand shock kicks in, GPM to remain stable (TP USD 34→USD 33) Bing Duan – NIHK / Ethan Zhang – NIHK / Joel Ying, CFA – NIHK

Reiterate Buy; TP cut to USD33, implying 18% upside

Action: Reiterate Buy with fine-tuned TP of USD33, shock wave from online education regulation largely priced in. As a leading global player in the RTE-PaaS market, Agora’s business expansion was hit by tightening regulations in the China internet space, especially in the online education sector. Although we expect the China market to suffer from sequential slowdown in 3Q21F and 4Q21F, we believe the overseas market would remain healthy. Corporates continue to suffer from fluctuations of COVID-19. We believe Agora should be able to achieve its FY21 revenue guidance of USD159~161mn, and slightly raise 2021-2023F revenue by 0.2-1.4% to reflect its continuous global expansion. We expect gross margin to continue its upward trajectory in 3Q21/4Q21F, owing to relieved pressure on infrastructure investment, and continuous cost optimization.

Quick Note – LG Chem (051910 KS) (Buy) – Building a 40GWh JV battery plant with Stellantis (TP KRW 1,150,000)

Cindy Park – NFIK

On 18 October 2021, LG Energy Solution (an unlisted subsidiary of LG Chem) and Stellantis (STLA IM, Neutral) announced the signing of an MoU to establish an EV battery JV in North America, with total annual production capacity of 40GWh. Batteries produced in the new JV plant will be supplied to Stellantis’ assembly facilities in the US, Canada and Mexico, and will be installed in EV/PHEV models of its brands. The groundbreaking of the plant is scheduled for 2Q22F, with mass production to likely start in 1Q24F. This investment forms a part of Stellantis’ electrification plans, where the company intends to electrify 40% of its US auto sales by 2030F and achieve 130/260 GWh of battery production capacity by 2025F/2030F. This JV would follow the business relationship between the two companies, initiated in 2014, when LGES first supplied its battery pack system and controls for the Chrysler Pacifica Hybrid.

AROUND THE WORLD

Macro Strategy Insight – Analysis of speculative positions

Naka Matsuzawa – NSC

US bond market flattens, shorts on JPY and longs on copper increase

Please also see today’s edition of Matsuzawa Morning Report (Start of downturn for VIX and upturn for MOVE, equities, and yields? / Will Fed rate hike expectations be corrected before the blackout?). In this report, we will use speculative positions as of 12 October to examine the implications for markets going forward. In the week that included 12 October, momentum was risk-off again in the first half of the week and the bond market bull flattened. The strength of commodities also waned. However, in the second half of the week, momentum turned risk-on and bonds bear flattened. Commodities also strengthened again. In the FX market, USD strengthened in the first half of the week and weakened in the second half. JPY was soft throughout the week. In the US bond market, short positions on 10yrs and 30yrs began to narrow, but shorts on 5yrs continued to increase, albeit slightly.

Macro Strategy Weekly – Three ways to interpret simultaneous appreciation of USD and cross JPY

Naka Matsuzawa – NSC

Should markets price in the start of Fed rate hikes now?

Week to search for evidence that manufacturing industry is picking up again. In the week of 18 October, statistics related to domestic demand, such as production and investment, will be released in China. Both are expected to show a slowdown, due primarily to power shortages, but if they show unexpected firmness, as exports did, it would add credence to a scenario in which manufacturing picks up again. The Chinese economy and related markets play a decisive role in determining whether this scenario happens or not. Industrial metals, which tend to reflect China’s economic conditions, have reached new highs since 2011, and China’s long-term yields, which have a strong tendency to lead US long-term yields, have returned to levels marked before the PBOC lowered the reserve requirement ratio in July, and RMB is strengthening despite USD appreciation. In the US, the Philly Fed Survey, Empire State Survey, and PMI are scheduled for release.

Matsuzawa Morning Report – Start of downturn for VIX and upturn for MOVE, equities, and yields?

Naka Matsuzawa – NSC

Will Fed rate hike expectations be corrected before the blackout?

Today’s Japanese markets. In Japanese markets on Monday, we expect bonds to weaken and equities to extend gains (in overnight futures trading last Friday, bonds fell 8 sen and equities rose JPY70 over OSE). While VIX fell in response to strong US economic data last Friday, the MOVE Index increased, with a clear division between equities and bonds. Commodities continue to strengthen and yields to rise (bear flattening along the yield curve), so predictions are difficult, but the risk asset market is beginning to show resilience. We think this is primarily because governments in key countries are considering and announcing a wide range of initiatives aimed at easing supply chain snarls and market participants are attributing the strength of commodities (particularly industrial metals) and high yields to demand factors (renewed growth in the global economy).

3D DRAM in the spotlight – Catalyst for the next stage of growth in the market for etching equipment

Tetsuya Wadaki – NSC

Could be key to breaking past the present limits on DRAM miniaturization

Steady progress in the development of 3D DRAM. The market is becoming increasingly interested in 3D DRAM technology. When we started exploring the possibilities of 3D DRAM in 2020, equipment manufacturers had almost nothing to say about the technology. In 2021, however, Tokyo Electron [8035] (Buy), ASML, and others have brought up 3D DRAM as a potential avenue for DRAM’s evolution. 3D DRAM got its start in 2011 with the announcement of a 3D DRAM concept by the US company MonolithIC 3D. There are four basic patents underpinning the technology, two of which are held by Samsung Electronics and two of which are held by Micron Technology. These patent rights were acquired in 2018 and 2019. The structural complexities of 3D DRAM. In broad terms, there are two approaches to manufacturing 3D DRAM, one of which involves forming deep bitlines in the third dimension, and the other of which involves forming deep wordlines in the third dimension instead.

Keyence (6861 JP) (Buy) – Our Buy rating reflects long-term profit growth potential (TP JPY 60,000→JPY 78,000)

Kentaro Maekawa – NSC

We focus on capacity to overcome effect of business cycle with sales efforts and merchandise

We maintain our Buy rating in view of long-term profit growth potential. Along with a change of analyst coverage, we update our earnings forecasts and valuation methodology for Keyence and reiterate our Buy rating on the stock. Operating profits fell 13% y-y in 20/3 and were roughly flat y-y in 21/3 because of weaker economic sentiment and the COVID-19 pandemic, but we look for a repeat of the scenario seen in 09/3 and 10/3, when profits fell for two straight years because of the global financial crisis before moving into a long-term growth cycle. We use a P/E of 42- 43x to calculate our target price, a premium to the P/E of 37x based on peak EPS during the profit growth cycle from 11/3 to 19/3 to reflect our expectation for profit growth to be sustained over the long term as the company overcomes the effects of the business cycle.

Japan electronic parts: data update – Chinese retail sales: communication appliance sales up 22.8%

Manabu Akizuki – NSC

Sharp recovery in communication appliance sales thanks to iPhone 13, but overall consumer spending lacks momentum

September retail sales of communication appliances rise 22.8% y-y, marking sharp recovery from August. Chinese retail sales data for September were released on 18 October. Sales of communication appliances (including smartphones) were up 22.8% y-y (down 14.9% in August, up 0.1% in July, up 15.9% in June), marking a sharp recovery. The statistics show that overall consumer spending lacked momentum, as in August, but communication appliance sales recovered sharply thanks to the launch of the latest iPhone models. The iPhone launch was late in 2020, with all models only available from the start of November. We think this resulted in a low y-y comparison base this time around.

Quick Note – Toyota Motor (7203 JP) (Buy) – Plan announced to make batteries locally for BEVs in the US (ADR : TM US) (TP JPY 2,600)

Masataka Kunugimoto – NSC

Investment plan for US automotive batteries announced. The company announced plans on 18 October to invest

¥380.0bn ($3.4bn) in local production of automotive batteries, including those for battery electric vehicles (BEVs), through 2030 in an effort to promote electrification. The main points for us are the following four. (1) Toyota Motor North America and Toyota Tsusho [8015] plan to establish a new company in the US with production starting in 2025 and for that purpose to invest ¥143.0bn ($1.29bn) in land and building structures through 2031; (2) the new company will initially make automotive batteries for hybrid electric vehicles; (3) Toyota aims for an electrified vehicle (hybrid electric vehicle, plug-in hybrid electric vehicle, battery electric vehicle, fuel cell vehicle) sales weighting in the US of 70% in 2030, up from 25% now; and (4) Toyota aims for annual electrified vehicle sales of 1.5-1.8mn in 2030.

Asia Insights – China: Growth down in Q3, and is set to slow further in Q4

Ting Lu – NIHK / Jing Wang – NIHK / Lisheng Wang – NIHK

September activity and Q3 GDP data released by China’s National Bureau of Statistics (NBS) today are in general below consensus, pointing to worsening growth prospects due to a combination of shocks on both the demand and supply side (see China: Double shocks pose a risk of a growth double dip, 24 September 2021). We expect real GDP growth to drop further towards 3.0% y-o-y in Q4 and could remain low in spring 2022 on strong headwinds including the property curbs and energy shortage. We expect Beijing to step up monetary and fiscal easing, but stick to most of its curbs on the property sector and restrictions on energy consumption and carbon emissions. The Chinese economy is slowing, and most data are below consensus. As we expected, most of the September and Q3 activity data released by the NBS today are below consensus, but above our forecasts (see China monthly: September and Q3 data preview, 27 September 2021).

Asia Chart Alert – Nomura’s leading index of Asian exports Rob Subbaraman – NSL / Rebecca Wang – NSL

Signaling a further slowdown in Asian export growth in Q4.

Nomura’s leading index of Asia ex-Japan’s aggregate exports, or NELI for short, is made up of eight forward-looking components and has a three-month lead time. It has correctly warned of past major turning points. NELI is signaling AEJ export growth could weaken further, as its latest November reading dropped for the fourth month in a row, although at a slower pace than the previous month, due primarily to indicators of China’s cooling economy. In line with NELI, of the five countries that have released September export data, three have reported weaker growth than in the previous month: India (22.6% y-o-y from 45.8%), Indonesia (47.6% from 63.6%) and South Korea (16.7% from 34.7%), although China (28.1% from 25.6%) and Taiwan (29.2% from 26.9%) bucked the trend. Our Chief China economist, Ting Lu, believes China’s export rebound is due to one-offs, and doubts it can be sustained.

Asia Chart Alert – India: A new high for business resumption

Sonal Varma – NSL / Aurodeep Nandi – NFASL

Supply-side issues (coal and chip) may limit production at a time when demand is seeing a robust rebound, risking higher inflation.

The Nomura India Business Resumption Index rose to an all-time high of 108.8 for the week ending 17 October from 105 in the prior week (pre-pandemic level=100), with a broad-based rise across most sub-components. Mobility indices rose sharply ahead of the festive season. The Apple driving index jumped 14.1pp over the week, while Google workplace and retail & recreation indices rose by 2.7pp and 3.1pp, respectively. The labour participation rate rose to 41.6% from 40.4%, while power demand fell 1.7% w-o-w (sa) after rising 0.3% in the prior week. The pace of vaccination has fallen in October, but India will cross the milestone of administering one billion vaccine doses this week. About 20.5% of the population is fully vaccinated and 50.4% have received at least one dose, which is enabling reopening and has boosted mobility.

Asia Insights – China: Home and land sales have weakened further so far in October

Ting Lu – NIHK / Lisheng Wang – NIHK / Jing Wang – NIHK

… suggesting the property sector downturn is still underway.

High-frequency data point to a further slowdown in China’s property markets in October thus far. Year-over-year growth in volume (floor space) terms for existing home sales and land sales in our tracked samples dropped to – 63.2% and -55.6%, respectively, for the first 17 days of October from -46.9% and -29.8% in September, while new home sales growth in volume terms improved to -24.2% from -30.1%. Adjusting for base effects, we estimate annualized 2y-o-2y growth in new home sales, existing home sales and land sales all weakened in month-to-date October, to -14.5%, -81.6% and -30.9%, respectively from -11.9%, -27.1% and -20.9% in September. A breakdown of the data suggests lower-tier cities have borne the brunt from the ongoing property sector worsening. The rapid weakening in the property sector in October so far bodes poorly for GDP growth and government revenue in coming months, supporting our below-consensus Q4 GDP growth forecast (3.0% y-o-y; Consensus: 4.1%).

First Insights – Singapore: NODX growth rebounded in September

Euben Paracuelles – NSL / Charnon Boonnuch – NSL

An encouraging rebound in NODX. Non-oil domestic exports (NODX) growth rebounded to 12.3% y-o-y in September from 2.7% in August, above the consensus forecast of 8.7% but lower than our forecast of 16.0%. On a sequential, seasonally adjusted (sa) basis, this implies NODX growth picking up to 1.2% m-o-m from -3.5%. This resulted in NODX growth moderating slightly to 9.1% y-o-y in Q3 from 10.1% in Q2 (Figure 1), partly reflecting base effects of gold exports last year. Excluding gold, NODX growth rose slightly to 20.5% y-o-y in Q3 from 20.1% in Q2. Still-strong chips exports. The negative surprise versus our forecast was mainly driven by growth of pharmaceuticals exports rising to 27.3% y-o-y from -12.4% on low base effects. On a sequential basis, this implies pharmaceuticals exports expanding by only 6.2% m-o-m after a sharp 40.6% drop in August.

First Insights – US: Industrial Production Drops in September due to Hurricane Ida, Utilities and Autos

Aichi Amemiya – NSI / Robert Dent – NSI / Kenny Lee – NSI

We believe underlying domestic industrial sector activity remains strong, and production should rebound in Q4, but auto activity could take longer

Total industrial production declines in September due to idiosyncratic factors. Industrial production declined 1.3% m-o-m in September, below our expectations and well below the market consensus (Nomura: -0.5%, Consensus: +0.1%). The sharp drop followed a 0.4% increase in August. The September report was distorted by three factors: Hurricane Ida weighed significantly on the report. The Federal Reserve estimated a 0.6pp drag on topline industrial production and a 0.3pp drag for manufacturing output specifically. Electric and gas utility output dropped 3.6% m-o- m in September as temperatures - and cooling demand – normalized following a warmer-than-usual August, subtracting another 0.4pp from topline output. Motor vehicles and parts output dropped sharply, falling 7.2% m-o-m, as shortages for semiconductors and other inputs weighed on factory activity. The decline in motor vehicle output subtracted an additional 0.3pp from topline production.

HONG KONG / CHINA

Anta Sports Products (2020 HK) (Buy) – Expect 4Q21F to improve (TP HKD 205.1→HKD 194.6) Emily Lee – NIHK / Emily Lee – NIHK

Maintain Buy; lower TP by 5.1% to HKD194.6

Plausible 3Q for core Anta. Core Anta posted retail sales growth of low teens y-y in 3Q21 (+mid teens vs 3Q19), decelerating from 2Q’s 35-40% and 1Q’s 40-50%. Anta’s impact from COVID-19 is less severe as its stores are mainly located in T2-3 cities on the street. The key positive of 3Q includes a better discount rate, which improved by 5pp y-y, a sell-through rate that improved by 10% vs 3Q19, while inventory level maintained at 5x, better off y-y and vs 3Q19. Management maintains its guidance of >20% growth for core Anta’s retail sales. FILA – 3Q retail sales growth slowed; 4Q recovery remains positive. FILA faced more challenges in 3Q21 from COVID-19 as they are located in higher-tier cities and malls where traffic slowed due to different lockdown measures as well as FILA’s higher reliance on apparel, which was affected by a warmer 3Q. 3Q21 retail sales slowed down to mid single-digit growth (+25-30% vs 3Q19) from 2Q’s 30-35% and 1Q’s 75-80%.

Ping An (2318 HK) (Buy) – Life business weakness continued in 3Q21… (TP HKD 101.31→HKD 95.18) Shengbo Tang – NIHK / Ivy Du – NIHK

…while Fortune Land overhang likely removed

Cut FY21F life NBV forecast by 5.4% on sustained pressure from supply-side reform and continued decline in agent headcount. We expect Ping An’s 3Q21F NBV to decline 30% y-y but largely stabilize q-q, before improving y-y in 4Q21F, given a low base and less emphasis on open-year sales. However, 1Q22F could remain challenging in terms of NBV growth given the high base effect. Overall, further to a 12% y-y decline in 1H21F, we expect the NBV downtrend to continue at roughly the same rate in 2H21F, leading to a 12% y-y decline for FY21F. China Fortune Land’s better-than-expected debt restructuring plan helps relieve market concerns around property investments. Based on an announcement made by China Fortune Land (CFLD), the company plans to use c.CNY57bn cash out of the total CNY75bn cash to be generated by asset disposals to repay debt.

Quick Note – JD Logistics (2618 HK) (Buy) – Annual GSSC conference takeaways (TP HKD 33) Thomas Shen – NIHK / Jialong Shi – NIHK

On 18 October, we attended the annual Global Smart Supply Chain (GSSC) conference hosted by JD Logistics (JDL) to discuss the latest trends in supply chain logistics, and showcase JDL’s new logistics technologies and services to its industry partners. During the conference, in addition to keynote speeches delivered by experts on industry trends, JDL’s management also made presentations on its key strategies and new technologies. We summarize the key takeaways below: To summarize, the messages delivered by JDL’s management is largely consistent with what was communicated during its 1H21 earnings conference call. Management aims to continue to strengthen its logistics capabilities by expanding the capacity of its warehousing network and delivery network (e.g., air cargo capability).

Quick Note – China Internet & New Media – Opening up to search likely not very impactful

Jialong Shi – NIHK / Thomas Shen – NIHK

On 18 October, Bloomberg reported that the MIIT of China is contemplating rules to require media companies such

as Tencent (owner of WeChat) and Bytedance (owner of Douyin) to open up their content to external search engines (such as Baidu), thus allowing their rivals to access their media content (e.g., articles from WeChat public accounts, video clips generated on Douyin) and display the media content in search results. The news report also indicated the regulators are still consulting internet companies for feedback and have yet to make a final decision. The reported opening-up to search unlikely to change users’ habits. While the MIIT’s final decision still hangs in the balance according to the news report (Bloomberg), we are inclined to believe that the potential opening-up would be unlikely to cause much of an impact on the industry landscape, as most Chinese smartphone users are already used to searching for various specialized content on dedicated vertical apps, such as searching for restaurants on Dianping, short videos on Douyin/Kuaishou, gossip and breaking news on Weibo and product prices on Taobao, rather than going through third-party search engines such as Baidu.

Quick Note – China Internet & New Media – Ecommerce sales accelerated in September

Jialong Shi – NIHK / Thomas Shen – NIHK

China ecommerce sales rose 10% y-y in September, accelerating from 5% y-y in August. On 18 October, the National Bureau of Statistics (NBS) released China retail data for September 2021. China’s ecommerce sales (excluding the sales of virtual goods and services) amounted to CNY870bn, up 10% y-y, vs +5% y-y growth in overall physical goods sales (offline + online). Ecommerce growth (+10% y-y) in September accelerated from 5% y-y in August 2021, largely owing to 1) a pickup in the growth of the broad retail market (+5% y-y in September, vs +3% in August); and 2) a relatively low base effect in September 2020 as the post-pandemic pent-up demand was released from May to August 2020. In 3Q21, China ecommerce sales grew by 9% y-y, slowing from 13% y-y in 2Q21. Please refer to our Alibaba note, JD note and Vipshop note for a preview of their 3Q21F results.

INDIA

HDFC Bank (HDFCB IN) (Buy) – Smart recovery post second wave (TP INR 1,750→INR 1,955) Nilanjan Karfa – NFASL / Amit Nanavati – NFASL

Stepping on retail growth pedal to improve PPOP performance

As implied during 1Q call, improved mobility and tapering health concerns led to better loan growth,collections and recovery. Its lending subsidiary, HDB Financials (HDBF, unlisted), reported more than 200bp improvement in Stage 3 ratio to 6.1%, although it remains elevated compared to 4.5% in Mar 2021. Management indicated that retail loan conditions have improved, and it is willing to chase market share which makes us believe that the retail to wholesale loan mix is likely to swing back. This should have a positive bearing on the overall NII growth and profitability (see here). We reiterate our Buy rating, with an increased TP of INR1,955, implying 4.3x 2Q FY23F book (3.9x earlier). Growth trends. Overall disbursements grew 70% y-y and 50% q-q in 2Q FY22. According to a reformatted loan disclosure, retail loan mix inched up 40bp q-q, with strong growth across credit cards and durables financing, LAP and unsecured personal loans.

India energy – 2QFY22F preview

Anil Sharma – NFASL / Aditya Bansal – NFASL

A better quarter for most names; 2Q likely to be strong for IGL, and the weakest for GGAS

RIL: sequentially better quarter for all segments after a subdued 1Q . We forecast consolidated EBITDA to be up 11% q-q and 28% y-y. For the oil to chemicals (O2C) segment, we expect EBIT to grow 4% q-q, driven by significantly improved refining, partly offset by weaker petchem as margins declined for most key products. For Jio, we expect 9% q-q EBITDA growth. We model in ~3% q-q growth both in subscribers (~15mn to 452mn) and ARPU to INR142.5/month (vs. INR138 in 1Q). Retail is likely to be the strongest as footfalls improved after the impact of the second wave of the pandemic in 1Q. We expect retail EBITDA to grow 53% q-q (47% y-y). OMCs: Core margins better, but q-q EBITDA likely to be lower due to lower inventory gains. SG complex margin further improved to USD3.7/bbl (vs. USD2.0/bbl in 1Q). Marketing margins on petrol/diesel should also improve as OMCs took sustained price hike till mid-July.

Quick Note – India Telecoms – DoT frames rules for equity conversion

Aditya Bansal – NFASL / Anil Sharma – NFASL

DoT sets deadline for telcos to opt for moratorium and equity conversion. As part of recent relief measures for telcos (link to our note), the Union Cabinet of India (The Cabinet) had allowed moratorium/deferral of up to four years on Adjusted Gross Revenue (AGR) and Deferred Payment Liabilities (DPL) on spectrum purchased in past auctions (excluding the 2021 auction). The department of telecom (DoT) has now set a deadline of 29 Oct-2021 for telcos to respond whether they would opt for the four-year moratorium. Telcos were also granted an option to pay the interest amount arising due to deferment of payments by way of equity. The DoT has given telcos a further 90 days to respond, if they would want to opt to convert the accrued interest due to deferred payments to equity (link). We note, the Government of India (GoI) also has an option to convert the due amount pertaining to the deferred payment by way of equity at the end of the moratorium period.

INDONESIA

Indonesia Cement – Sept’21 Volume: Strong recovery

Tushar Mohata, CFA – NSM

Expect 4Q21 to continue to recover

The Indonesia’s cement industry sold 6.4mt of cement in Sep’21 (+4% y-y/+7% m-m), continuing the Aug’21 recovery (+2% y-y / +9% m-m) trend on the back of relaxation of social restrictions and improving construction activities. Both infrastructure and property construction have been ramping up, as can be seen in September 2021 bag/bulk sales, which have been the highest since January 2020. 9M21 showed +5% y-y growth. Interestingly, cement volume in 3Q21 showed +3% y-y growth despite strict social restrictions in the Java-Bali area during Jul- Aug’21. We think this likely resulted from strong growth in ex-Java from a low base in 3Q20 (3Q21 Kalimantan/Sulawesi: +13%/23% y-y). Note that tier-2 players’ 3Q/9M21 growth was +11%/+20% y-y. We believe that 4Q21 volume will continue to recover amid infrastructure and property construction ramp-up to the end of the year. Currently, SMGR IJ/INTP IJ are trading at cheap valuations of USD90/USD93 EV/ton (vs 5-yr average of USD119/USD154 EV/ton). Hence, we retain our Buy ratings on these stocks and a positive view on the whole cement sector.

TAIWAN

Quick Note – Hon Hai Precision Industry (2317 TT) (Buy) – 2021 Tech Day: Hon Hai debuts three EV models (TP TWD 152)

Anne Lee, CFA – NITB / Gillian Yen – NITB

Debut of three EV models within a year proves feasibility of Hon Hai’s EV strategy

At Hon Hai’s 2021 Technology Day held on 18 Oct, the debut of three EV models after just one year of preparation (see our 2020 Technology Day report) reaffirms our positive view on the company’s long-term EV strategy. Although the three EV models are just running prototypes (or so-called reference designs), which can be adjusted based on customers’ requests, we think Hon Hai has efficiently put a lot of supply chain resources (MIH alliance has 2000+ members) together to come up with these reference design solutions to help its customers accelerate their entry into the EV field. For the ebus (Model T), we were impressed by the test ride experience in terms of manoeuvrability and controllability, as well as the user-friendly design in terms of info display, safety, and sensing.

Lite-On Technology Corp (2301 TT) (Neutral) – 3Q21 EPS miss on sales shortfall and one-offs(TP TWD 69→TWD 73)

Anne Lee, CFA – NITB / Gillian Yen – NITB

Opto, Auto and Cloud (including 5G-ORAN) are three key growth drivers for 2022F

Action: Maintain Neutral; lift TP to TWD73, implying 13% upside. We reaffirm Neutral and raise our TP to TWD73, based on 13x 2022F EPS of TWD5.6 (same methodology). Despite the global IC shortage causing shipments push- out at LOT’s various businesses (also a common challenge faced by most tech companies), LOT believes that: 1) Opto, 2) Auto-related businesses (e.g., camera and EV charging), and 3) Cloud, including 5G O-RAN will be the key growth drivers in 2022. We raise 2021F earnings by 16.7% to reflect higher marked-to-market gains for Vizio in 1H21, but slightly lower 2022F earnings by 1.2% to reflect lower interest income, given the reduced cash position after share buybacks. We think LOT’s recent efforts to enhance shareholders’ value, such as share buybacks, more frequent cash dividend payouts, and enhanced ESG and transparency, are positive to support its long-term valuation.

THAILAND

Airports of Thailand PCL (AOT TB) (Buy) – Lower earnings on revised passenger forecasts (TP THB 81→THB 78)

Ahmad Maghfur Usman – NSM / Divya Thomas – NSFSPL

We expect weak 4Q21F performance on continued domestic flight ban; lower TP to THB78

Lower earnings and pax assumptions, likely difficult 4Q21 (ending Oct-21) ahead. Nomura hosted an Investor Day with AOT’s management on 14 Oct 2021; we revise down our passenger assumptions for FY21F/22F/23F to 19.9mn/41.4mn/114.6mn to factor in the company’s latest operational performance. We also incorporate the company’s updated capex guidance (Fig. 1) into our model. We revise down FY21F/22F estimates to THB11.6bn/ THB6.97bn of losses, vs profit earlier, and lower FY23F earnings by 17% to THB27.5bn. We expect 4Q21F performance to be poor given that domestic flights were grounded from mid-July to mid-August as COVID-19 cases peaked. Investor Day updates. AOT has not yet taken a decision on whether the relief program for concessionaires (see our earlier note) will be extended beyond Mar 2022 (we have incorporated a waiver for the full-year FY22 into our estimates).