- Our Greater China semiconductor team downgraded Amlogic (688099 CH) to Neutral because they think demand softening could be worse than expected.

- Our Korea Memory team, commenting on Korean semiconductor exports for June,sees further downside to its 3Q22F shipment forecasts, as memory suppliers are adjusting shipment growth to protect ASP. It expects memory ASP to decline just 5% q-q in 3Q22F, more than cost reduction but less than in the previous memory down cycles. It believes semiconductor exports in 3Q will be flat to down -5% q-q, contingent on shipment and price movements. The team is maintaining its positive view on the memory sector, noting that valuations of memory suppliers have already reached historical trough levels.

- Our India IT services team believes the near-term revenue growth outlook (for FY23F) for the sector remains strong, but uncertainties have increased significantly for the FY24F growth outlook. The team still sees downside risks to the consensus revenue growth forecast for FY24.

- Our Display team commented that with lockdowns triggered by rising number of COVID-19 cases in various cities in China and downward pressure on the China economy, it has seen demand for consumer electronics generally showing a weakening trend. Looking at the panel price trend into 2H22, the team sees further price pressure for most of the large-sized panel applications.

Chip downturn beginning

Last week on June 30, Micron reported a solid May quarter but guided for a meaningful q-q sales decline for the August quarter, which is typically seasonally strong (Micron earnings — tech read-through .)

Micron’s sales grew 11% q-q and 16% y-y in the May quarter, but it guided for the midpoint of its August quarter sales to decline 17% q-q and 13% y-y.

August quarter guidance assumes q-q bit shipment declines in both DRAM and NAND. Management noted that consumer demand and inventory-related headwinds impacted its August quarter guidance.

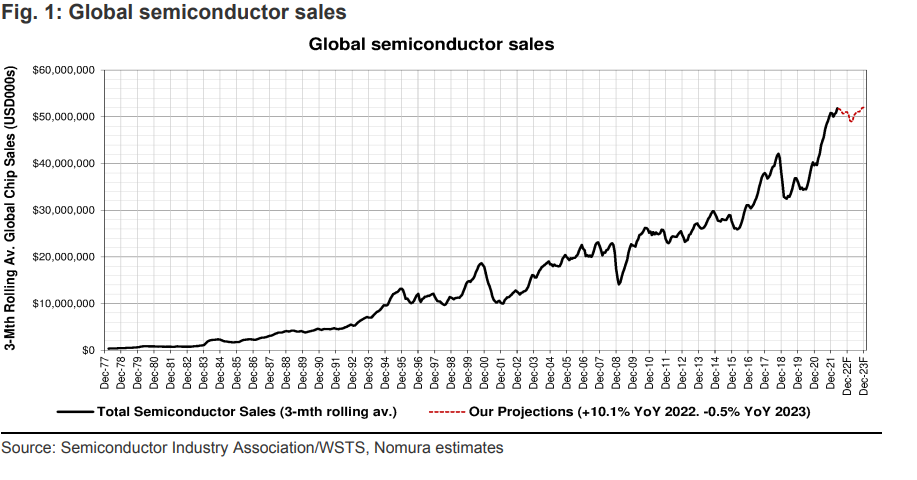

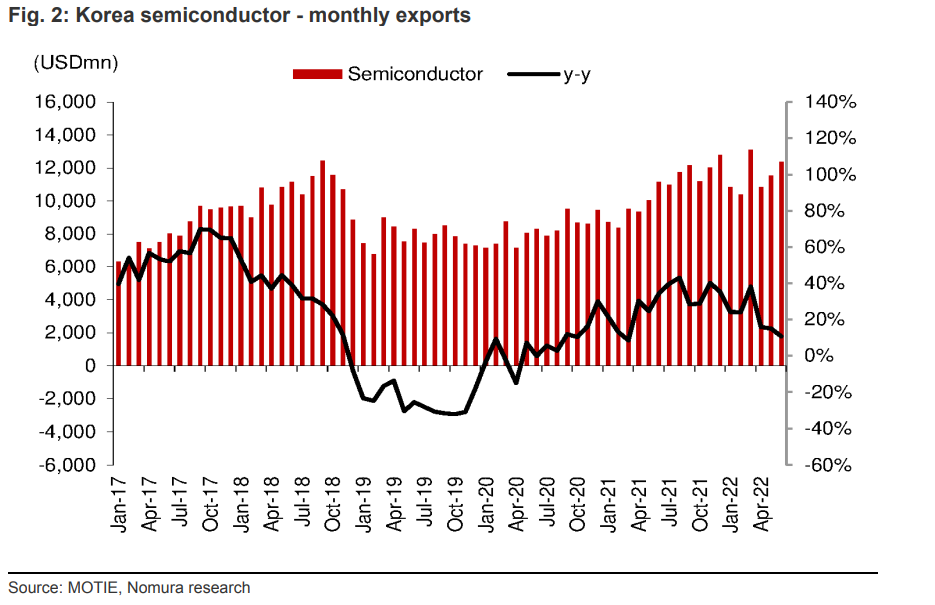

Management expects inventory to rise in the August quarter, by “a couple of weeks”. We expect that over the next month, as semiconductor and other technology companies provide guidance for the September quarter when reporting their June quarter earnings, reports of weakening demand (Anchor Report: Asia Pacific Technology – Heading into downturn, cautious on stocks ) will continue. In Korea, June export data showed that 2Q22 Korean semiconductor exports were the highest in June, but June exports were below March exports of USD13.1bn by 6% (Fig. 2, Korea exports for June). Our memory team noted that for the quarter as a whole, 2Q22 Korean semiconductor exports of USD34.7bn were similar to 1Q, below the team’s original expectations of at lest 10% qq growth in 2Q. We continue to expect steadily deceleration in y-y chip comparisons through 2022F and a decline in global chip growth in 2023F (Fig. 1 ) .

Nevertheless, semiconductor demand appears to have held up relatively well in recent months despite lockdowns in China and the Russia-Ukraine conflict. Global semiconductor sales data reported by the Semiconductor Industry Association / WSTS on 4 July showed total semiconductor sales were up 19.0% y-y in May, compared to 11.8% growth in April and 23.1% growth in March. The three-month rolling average of

semiconductor sales rose 1.8% m-m in May, following 0.7% growth in April and 1.1% growth in March (Global chip shipments for May ). We think that news from technology companies over the next 1-2 months may well be mixed, ranging from some companies

noting meaningful weakening in demand to others commenting on demand remaining fairly stable.