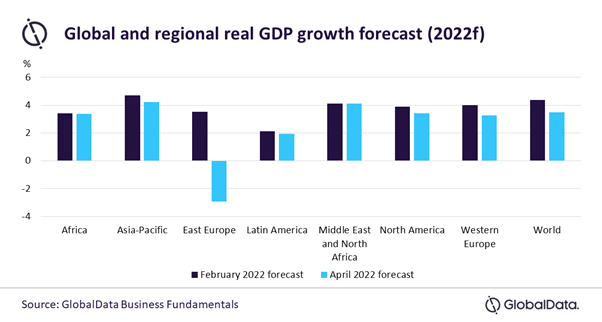

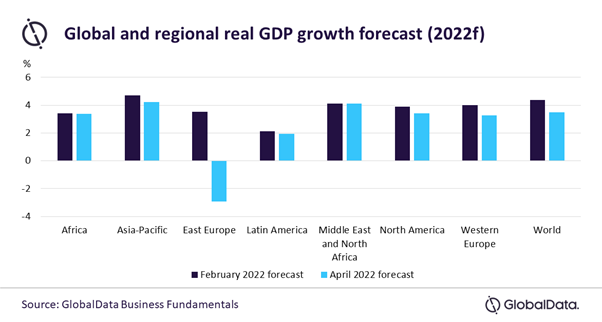

GlobalData has downwardly revised its global economic growth forecast for 2022 from 4.4% in February to 3.5% in April 2022. The leading data and analytics company notes that this decrease is due to deepening supply chain disruptions, vaccination inequality and higher inflationary pressures amid the Russia-Ukraine war.

Ramnivas Mundada, Director of Economic Research and Companies at GlobalData, comments: “Global geopolitical tension is increasing the risks involved with investment and trade, as well as causing fluctuations in consumer demand. Further, prolonged conflict between Russia and Ukraine will continue to impact global growth in terms of production, trade, and employment. Major economies will continue to adopt tighter monetary policies to tame inflationary pressures amid rising oil and natural gas prices.”

GlobalData has revised its forecast for real gross domestic product (GDP) growth in most regions: 0.5 percentage points (pp) for Asia-Pacific, 6.5pp for East Europe, 0.7pp for Western Europe, and 0.5pp in North America by 0.5 pp.

However, GlobalData anticipates that the Asia-Pacific region will be the fastest growing region in 2022, with its real GDP growth rate forecast at 4.2%. This is followed by the Middle East and Africa (MENA) region (4.1%), North America (3.4%), Africa (3.4%), West Europe (3.3%), Latin America (1.9%) and East Europe (-2.9%).

Mundada continues: “India and China are forecast to grow by 7.7% and 4.5%, respectively, in 2022. Despite the risks and the expected slowdown in economic growth, India and China are expected to drive global growth. Other countries such as Vietnam, Bangladesh, Malaysia, and the Philippines are projected to register above 6% growth in 2022.”

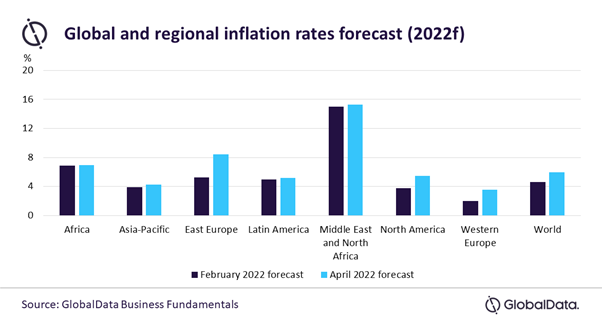

Global inflation is expected to rise to 6% in 2022, from 3.5% in 2021, due to a sharp rise in oil and gas prices, which is putting an upward pressure on the prices of goods and services. GlobalData forecasts a 6.6% inflation rate for the US alone, which is well above the Fed’s long-term target of 2%. Meanwhile, Eurozone’s inflation targets of 2% will be exceeded by major European countries in 2022, according to GlobalData.

Mundada added: “Western sanctions on Russia, a leading producer and exporter of crude oil and natural gas, has made oil prices skyrocket, and higher oil prices has had a knock-on effect on overall commodity prices. With mounting inflationary pressures, central banks of major economies have adopted monetary policy-tightening measures that might hurt investor sentiment amid the Russia-Ukraine war.”

On the other hand, COVID-19 vaccine inequity among developed and developing countries will continue to undermine global economic recovery in 2022. While North American and West European countries have achieved COVID-19 vaccination rates of more than 60%, African countries such as Nigeria, Zambia and Kenya have vaccinated less than 16% of their population, as of early April 2022.

Mundada concludes: “The risk to global economic recovery heightened in 2022 amid the Russia-Ukraine war. Despite households having accumulated huge savings, which once invested will drive up economic activity, rising prices are acting as a deterrent to spend.”

ENDS

For more information

To gain access to our latest press releases: GlobalData Media Centre