Will the real Italy please stand up?

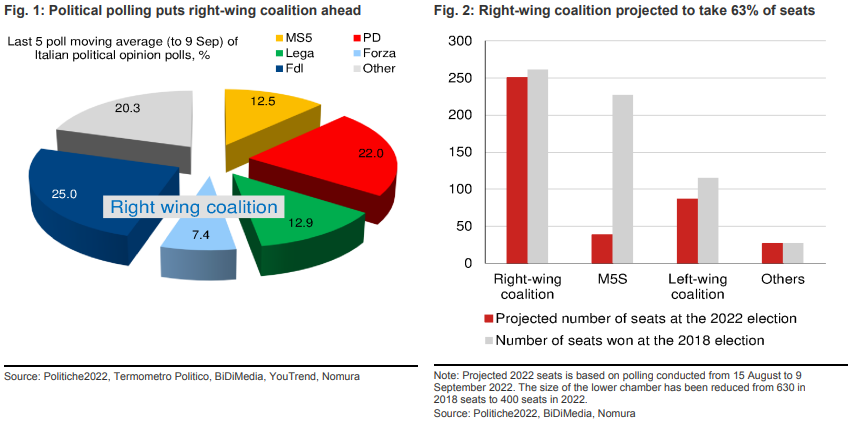

Italy faces elections on 25 September. The right-wing coalition, led by Giorgia

Meloni’s Brothers of Italy (FdI), is currently favourite to win according to the latest

opinion polls. There is much uncertainty, however, as no opinion polls have been

conducted since 9 September (the start of the blackout period) and almost 20% of

Italians remain undecided on whom to vote for.

•The eventual balance of power within the right-wing coalition will be key in

determining whether the government is willing to continue along the path of

implementing the reforms necessary to obtain Next Generation EU (NGEU) funding

and support Russian sanctions, or whether Italy ends up being Europe’s weakest link.

•We flag risks that Italy may struggle to achieve its gas and electricity consumption

reduction quotas, which may end in rationing and blackouts, thereby testing the

resolve of Italy’s fragile incoming government. Ultimately, this may yet result in

BTP/Bund spreads spiking, which would risk pushing the ECB to its limits.

•We are cautious on the outlook for Italy, conditional on the likely outcome of the

election, and we highlight that risks to Italian assets remain skewed to the downside.

•United we win, divided we don’t

Mario Draghi’s technocratic government collapsed on 21 July, following a vote of no

confidence. Consequently, Italy now faces elections this coming weekend – 25

September. The right-wing coalition, led by Giorgia Meloni’s Brothers of Italy (FdI), is

currently favourite to win according to latest opinion polls (Figure 1). This coalition also

consists of Matteo Salvini’s Lega and Silvio Berlusconi’s Forza Italia.

The right-wing coalition is largely set to win because the three aforementioned political

parties have formed an alliance to not contest against each other in the 37% of seats

allocated by first-past-the-post voting. Meanwhile, the left have appeared divided and

splintered during the election campaign, with the alliance between the PD and Action

parties collapsing within a week of it being formed in early August.

Ultimately, it appears Italians may have rewarded the right-wing coalition partners for their unity, punishing the

left for their infighting and squabbling. Current opinion polls put the right-wing coalition on

almost 46% of the vote.

While the result remains to be seen, the possibility of a right-wing coalition attaining a twothirds majority is a risk. We say ‘risk’ because to the extent that such an outcome would

enable the government to amend the constitution without a popular referendum, such that

markets may react negatively. At present, projections by Politiche2022 and BiDiMedia

suggest the right-wing coalition would attain 250 of the possible 400 seats in the lower

house – the Chamber of Deputies (Figure 2) – i.e. around 63% of the seats. This result is

largely a feature of Italy’s hybrid electoral system, with some seats allocated by first-pastthe-post, and the remainder by proportional representation.

Despite this strong showing for the right-wing coalition, opinion polls stopped on 9

September due to Italy’s blackout rules on election polling, so the current position is unclear.

Moreover, there has been a relatively large number of undecided voters – approximately

20%. Hence, material risks exist; political opinion polling is a highly uncertain business, but

even more so when there are such large numbers of undecided voters.

In our view, both a weak and too strong a coalition government could be negative for

markets, and Italy’s macroeconomic outlook. The former could reintroduce further political

uncertainty in that the risk of the government collapsing could be high, whereas in the

latter: (i) the government may prove too bold in certain reforms (such as often-floated

implementation of an elected presidency) or (ii) it has been suggested that a strong result

for FdI yielding more seats than expected indicates the party will be forced to go further

down its lists to fill seats, with the possible result that more militant members are selected

that may demand more extreme policies be implemented.

Indeed, should the incoming government win a super-majority this may raise alarm bells in

Europe, for fear that the administration may use its more significant powers to make

constitutional adjustments that go against EU principles. Indeed, some news stories

(Bloomberg, FT) have drawn parallels to rule-of-law issues in Hungary and Poland which,

if similar circumstances come to pass in Italy, could prevent the dispersal of NGEU funds.