By Eric Labbé, Thematic equity manager at CPR AM

I – 2018 was the worst trading year since 2008

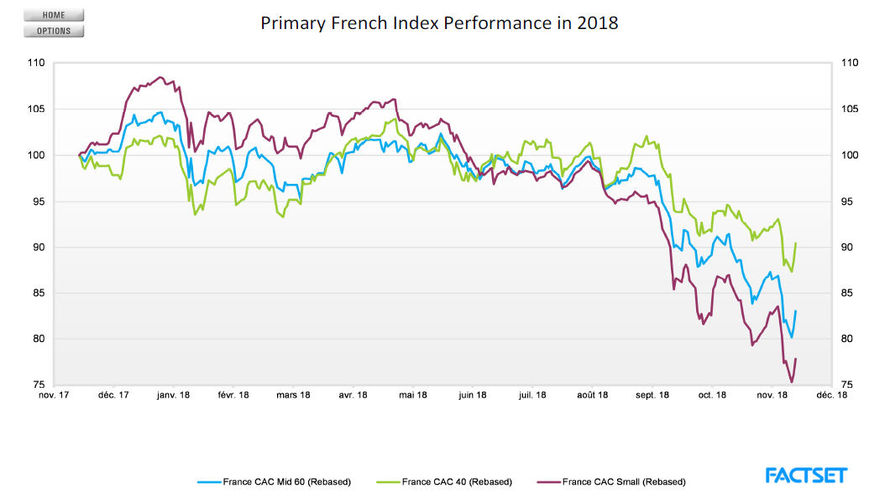

1-1 A bloodiest fourth quarter After a lacklustre overall performance during the first nine months of the year, the main stock markets fell sharply in Q4 to finish the year at their annual lows.

In a context of anxiety, the correction was even more severe for the French small and midcaps, which were the collateral victims of a flight to liquidity movement, with the following specific sequences:

- In addition to the BREXIT issue and the Italian budget problem, the FED confirmed its policy of raising interest rates, fueling investors’ fears of excessive tightening.

- Profit taking on the US stocks that performed best, i.e. technology stocks (NASDAQ), and therefore by extension growth stocks.

- Overall increase in market volatility, traders cut their “short” positions on volatility or hedge by selling the stock market (return of the “Volmageddon” even if it was of smaller magnitude than at the beginning of the year – losses have left their marks). Systematic strategies that sell risky assets in the event of increased volatility (risk parity funds) cut their positions.

- Algorithms amplified the trend. Acceleration of the decline in equity markets.

- Start of value-for-growth arbitrage.

- In the euro zone, small and mid-caps have long been held by investors through funds. However, the levels of capital gains are ” very comfortable “. Faced with rising volatility, some investors massively cut their positions to avoid being “trapped” by a lack of liquidity in the event of a sell off.

- Significant redemptions required selling positions at any price. However, small and mid-cap funds are generally concentrated. In recent years, small and mid-cap funds have been focused on “growth stories”. The latter have therefore become the main “victims” of the “sell off”.

- The violent declines ultimately worried investors who were still invested, who in turn sold, causing a “snowball” effect.

- The sales of year-end window dressing led to another round of sell-off.

Overall, French small and mid-cap funds recorded outflows of more than 10% of total assets over the year – source: Portzamparc – of which more than 8% in the second half of the year with peaks in October and December. In addition, 50% of the outflows from mid small cap equity funds in the euro zone were concentrated in France – source Exane.

1-2 An upturn in profit warnings

Although 2018 was not such a bad year, it was nevertheless characterized by a significant number of profit warnings with around 45% more profit warnings than the average of the last 4 years, which can be explained by the following reasons in particular:

- Margin pressures have been stronger than expected due to commodity inflation or recruitment difficulties (for some sectors),

- The dollar effect remained negative,

- The implementation of IFRS 15 on the recognition of income has not made it easy to interpret the results.

This increase in profit warnings has also impacted companies with a defensive profile. Many of the 2018 equity underperformances occurred in a single trading session during which the stock was heavily punished following a disappointing publication.

Indeed, mid and small caps started the year with a 25% premium over large caps, while their earnings growth was equal to that of large companies. Historically, however, the earnings growth gap has been 50% in favour of small and mid-cap companies.

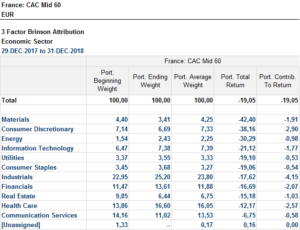

1-3 Performance analysis of the CAC mid 60

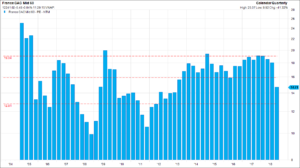

The CAC Mid 60 posted a very poor performance with a decline of -19.04% in 2018. The decline was slightly smaller than that of the Paris Stock Exchange Small Cap Index due to greater liquidity and the positive stock market performance of the first three weights of the index.

No sector was immune in 2018 from the fall in equity prices. The most penalized sector was, not surprisingly, the automotive equipment manufacturers following the global tariff tensions and the impact of the new WLTP regulation. Over the year, only 22% of stocks closed in positive territory, while in the last quarter only 10% of stocks recorded a positive performance.

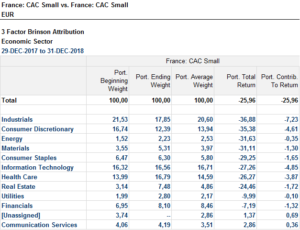

1-4 Performance analysis of the CAC small

The CAC Small is the index that suffered the most in 2018 with a decline of -25.96%, by far its worst performance since 2008 :

- Only 10% of the stocks closed the year in positive territory.

- Here again, all sectors in the index had a negative performance. Distribution and the Automobile sectors were not surprisingly the two sectors that suffered the most.

The investors therefore “repriced” the liquidity premium of the asset class.

II – Outlook 2019: a year of caution

2-1 Quantitative view of the market: repricing in progress and still significant earnings downgrades

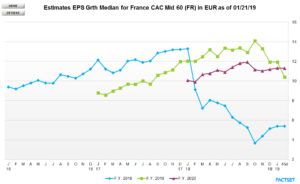

Multiples in line with historical records (PE ratios came back under their long term average)

In the event of a major crisis, these multiples will lose their significance, but the “excitement” that the mid- and small cap universe has known in recent years has disappeared.

Median earnings growth on the CAC mid 60 remains slightly above +10%, when the MSCI EMU earnings growth is at +8.5%.

2-2 Qualitative view of the market: more cautious, but not gloomy

The perception of the economic situation is slightly less optimistic than last year.

- Many companies have made efforts to have a more disciplined approach in their cash flow management and to pay a particular attention to dividends (optimization of their investments or working capital),

- Unlike last year, the regulatory / fiscal framework will be less favorable: postponement of the reduction in the corporate tax rate, transformation of the CICE.

- Cautious use of leverage with uncertainties about credit spreads

- Selective M&As. Rates are still low, so in theory they should favour investments or M&A activities. We feel that companies are more selective (rates are still low but access to debt is sometimes less easy) or more opportunistic and, in any case, less systematic or more price sensitive.

- The consumer segment has been impacted by the “Yellow Vests” effect, although the latter did not jeopardized guidance or fundamentals and had different but often moderate impacts.

- Unlike last year, raw materials or the €/US parity are no longer a concern for company managers.

The parallel with the outbreak of the 2008 crisis remains in everyone’s mind, especially since the magnitude of the impacts had been greatly underestimated in the business perspectives. The answers seem reassuring:

- Issuers have learned the lesson of 2008: they have refined their indicators, and are able to react much more quickly

- Balance sheets are stronger than in 2008

- Cash flow management has become key

2-3 Market timing : a complex entry point before the publication of the 2018 year-end earnings figures

On the issuers’ side: a certain misunderstanding about the level of current prices will lead to great caution in communication.

The sharp drop in their equity price in the context of press articles dealing with particularly negative business conditions is not in line with their backlogs, which remain at satisfactory levels, thus raising some questions about the appropriate communication of the 2019 outlook. Issuers will be all the more cautious as the base effect versus the fourth quarter 2017 is significant.

On the investor side, a return to the mean valuations could suggests attractive entry points. However, these levels can be undermined by considerations external to the companies’ business models. While the seasonality of the mid cap relative performance compared to the MSCI EMU did not hold over the year 2018 (due to the change in the valuation / earnings growth ratio), our market timing indicator is now at entry points (underperformance of -5% over 3 sliding months).

In Conclusion:

On the basis of:

- GDP growth in the euro zone in line with its potential,

- in a context of changing monetary cycles.

Taking into account:

- uncertainties about Brexit, which may initially disrupt logistics supply chains,

- and a US-China trade agreement that can be negotiated at the cost of European companies.

It seems to us that the earnings revisions for the “midcap France” asset class are still too high and that the repricing of liquidity risk is not yet completed. Therefore, we will not take the risk of reinvesting before the publication of results.

ARTICLE EN FRANCAIS: FOCUS Small and Midcaps