By Samer Hasn Market

US dollar has been able to recover significantly since late last November against a number of major currencies. These rises came despite the continued flow of data indicating that inflation continues to ease and return to its normal path.

Consumer Price Index (CPI) inflated by 3.24% last October on an annual basis, which is slightly close to the lowest levels since the first half of 2021. Inflation also continued to decline at the level of the core Personal Consumption Expenditures Price Index (core PCE), the preferred by the Fed, to 3.46%, which is the lowest level we have not seen since April of last year.

The various inflation readings and expectations helped strengthen the markets’ expectations that the Fed is actually done hiking interest rate and move towards cutting it sometime next year. These expectations pushed bond yields to record their lowest levels in months. The yield on ten-year Treasury bonds fell to less than 4.2%, the lowest level in three months.

Inflation-adjusted bond yields declined sharply last November as nominal yields fell. The real yield on ten-year Treasury bonds is at 0.974%, which is slightly close to the lowest levels since mid-October.

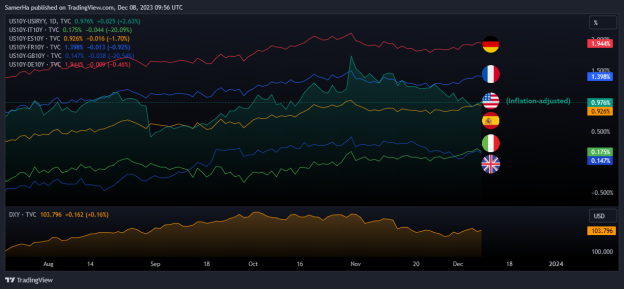

Despite the lackluster performance of bond yields, whether nominal or real, we still see a further widening of the yield gap between them and their corresponding Eurozone and British bonds, especially since the last week of last November.

Look at the following chart, which displays the yield gap between ten-year US Treasury bonds and their corresponding bonds of some Eurozone and British countries, in addition to the inflation-adjusted yield on ten-year Treasury bonds and the performance of the Dollar Index:

Source: TradingView

The widening yield gap appears to reflect some aspect of the future path of interest rates on both sides of the Atlantic. On the one hand, the US appears set to soft-land inflation and avoid recession despite record interest rate levels, with a strong banking system and corporate profitability but some weakness in the labor market.

On the other hand, various economic activities in the Eurozone are still recording further contraction, albeit at a continuing slow pace. However, the contraction is still continuing and the restoration of growth does not appear to be close, despite the continued decline in investor and individual pessimism over the past three months.

The situation is almost the same in Britain, but with more positive signs in the services sector, in contrast to the continued fragility of the housing market, represented by weak demand and the continuing decline in construction activities.

The previous weaknesses, if they persist and worsen, may prompt monetary policy makers in both economies to reconsider holding on to high interest rates and moving towards lowering them in the near future.

This disparity in trends across economies may keep investors more attracted to US bonds. This was actually demonstrated by more massive flows into bond ETFs last month and throughout the second half of this year.