By Hani Abuagla Senior Market Analyst at XTB MENA

Economic background is fundamental to any investor – short or long term focused. Over the past few years the importance of geopolitical trends has increased as well. For this reason we start our report by providing our outlook on the economic and geopolitical situation.

Will the landing be soft?

The economic situation over the past few years has been very volatile. An already mature economic cycle has been interrupted by the COVID pandemic and everything that followed: massive stimulus, inflation and resulting interest rate hikes. Understandably there were fears that this monetary tightening could lead to recession and those fears impacted markets significantly. However, so far the economic slowdown has been limited and some indicators suggest that a through of a slowdown is already behind us.

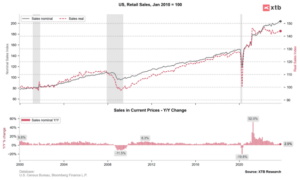

Chart 1: US consumer demand remains surprisingly strong, defying slowdown fears

This is true for indicators of business activity but more than anything consumer demand has been resilient. Yes, real sales over the past two years were more or less flat but this is still above long-term trend as 2021 numbers were inflated by heavy stimulus. While measures of consumer confidence remain subdued and there are opinions that extra savings from the stimulus period have now been exhausted, we are yet to see a reflection of this in hard data. Make no mistake, we are still right after the most aggressive tightening cycle in more than 4 decades so the risks are there but so far the US economy has been surprisingly resilient and if the Fed can lower rates substantially next year, this could save the US from a more serious slowdown.

Can Europe escape recession?

While the US is surprising to the upside, Europe is disappointing. Business activities like the PMIs show that the situation in Europe is already the most difficult among the key economic regions. We saw an especially deep decline in manufacturing, as a result of the following factors:

- post-COVID inventory buildup

- Much higher energy prices

- Progressing deglobalization

- Ambitious EU climate policies

While globally manufacturing companies seem to be slowly chopping through the inventories, in Europe the burden of other factors could be too heavy. There have been hopes that consumers will lift the economy through the services sector but the contrary seems to be taking place. One must remember that the current ECB deposit rate is 4% while it was negative for the past few years and close to zero for more than a decade. As a result it’s hard to be positive on consumer demand going into 2024. While the US economy seems to be holding up, Europe might be poised for some kind of a recession and its severity will be decided by the global environment.

Is inflation a story of the past?

The year 2021 brought the inflation scare that resulted in the most impressive monetary tightening in the Western World in decades and related recession fears. We have already stated that the US has survived and could escape recession while Europe is in much weaker shape. However, the exact magnitude of economic slowdown we are through will depend on the length of restrictive policies maintained by main central banks and this will depend on inflation.

Let’s start with the good news – inflation is poised to decline both in the US and Europe next year unless some kind of external shock occurs. In the US, the main driver of lower inflation will be shelter. Real estate prices and rents are at all time highs after steep increases. However, they barely grow now and CPI shelter inflation reacts to real estate prices with significant (1-year plus) delays. Therefore we are nearly guaranteed lower shelter inflation next year and for overall inflation to re-accelerate we would need other sources. However, with subdued fuel prices and relatively contained services inflation this is not likely at the moment. In Europe, weak consumer demand and fading effects of the energy crisis (energy prices are higher than prior to the shock but they have greatly retraced from the highs) should cool CPI inflation as well.

The bad news is that some of the inflation could be structural (that is – long term). This stems from de-globalisation and changes in labor markets where aging societies and post-COVID changes may pressure wage growth a bit more. Those factors will not outweigh short term trends pointed at above but may mean that a return to super low interest rates might not be possible (except for crisis situations).

Geopolitics – will it get worse?

We live in a World where geopolitical tensions have become a part of the picture that an investor must pay attention to. In 2022 we had aggression towards Ukraine, in 2023 the Middle East crisis but those seem to be just proxies to the biggest fight for global dominance between the US and China.

It looks like both countries are on the collision course regardless of what the leaders are saying: the US is trying to contain China and prevent it from developing high-end technologies, especially those that could be used in the military. China, conversely, tries to maintain free trade for as long as it profits from it to build its position. It’s pretty clear the interests are conflicting and while an extreme turn of events (like Taiwan invasion) is unlikely to happen next year, we are bound to see more friction on the geopolitical scene.

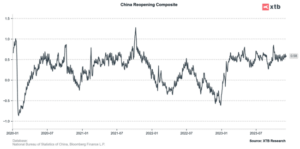

Chart: Activity in the Chinese economy soared right after the re-opening, only to falter soon after

Uncertainties around China are not limited to geopolitics. Economic situation is far worse than expected. When Beijing suddenly withdrew COVID restrictions at the end of 2022 expectations were really high. But after a short-live rebound the economy stagnated and was unable to gain momentum despite interest rate cuts and stimulation efforts (although of limited scale). It could be that China is paying the price for stimulating the economy via the residential market for decades and now that this source of growth is gone a slowdown might be unavoidable.

EURUSD

Examining EURUSD from a technical standpoint, after the price managed to climb back above parity, it maintained an upward trajectory until July 2023. However, this pullback should be interpreted as a correction within a larger downward trend. If the principles of technical analysis hold true, the declines experienced in late 2021 and early 2022 could reinitiate. Provided the price continues to trade below the resistance level at 1.1280, further sell-off and a continuation of the long-term downtrend is the most likely scenario. The downtrend could potentially accelerate if the price descends below the 1.04, which would be viewed as a bearish signal in the classical sense of technical analysis – signifying a break below the neckline of a broad head and shoulders formation.

EURUSD traded in a relatively tight range in 2023 after recovering above parity in late 2022. This lack of direction has been caused by the two major forces pulling the pair in opposite directions: relatively weaker EMU economy on one hand and upbeat market sentiment on the other. A strong autumn for the pair was a reflection of declining expectations for the Fed rates in 2024.

Yes, the Fed has room to cut next year but equally such cuts might be necessary in the eurozone. One could argue that the economic situation in Europe might pressure the ECB sooner. Even now looking at bond yield spreads remain relatively constant (markets keep pricing in sooner cuts on both sides of the Atlantic) thus not supporting the EURUSD pair. If the US remains resilient or if Europe slides into recession, those spreads might actually turn even worse for the euro. From the market sentiment point of view things look good right now but investors need to remember that any deterioration in sentiment is usually negative for the euro.

Bond spreads do not provide a strong case behind further EURUSD gains.

Wall Street – is Fed driving stock markets?

Wall Street indices recovered a bulk of losses recorded in the previous year during 2023. Gains came in spite of Fed hiking rates to the highest level since March 2001. While the US central bank does not want to admit it yet, the rate hike cycle looks to be over and the market is increasingly focused on potential interest rate cuts. The question seems to be not whether the Fed will cut rates in 2024, but when will it cut rates. General understanding is that rate cuts are good for stock markets and the economy, and rate hikes are bad. However, is the relationship between stock market and interest rates so crystal clear?

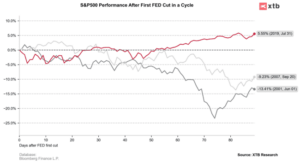

Analysis of three previous Fed rate cut cycles leads us to an interesting conclusion – rate moves alone do not drive stock markets and need to be put into broader context. Rate cuts that began cycles in 2001 and 2007 failed to lift market sentiment over the coming months, with broad US stock market indices moving lower. On the other hand, a rate cut that began a cycle in 2019 was followed by stock market gains in the following months. What looks to be key to stock market performance after rate cuts is what was the reason behind them. Cuts delivered in 2001 and 2007 were a crisis response, while a rate cut delivered in 2019 was a response to inflation weakness. Therefore, it will be more macro than the Fed that should be eventually crucial for the stock market as it will decide the path for earnings.

Chart: S&P 500 performance after first Fed cut in a cycle.

The figures refer to the past. Past performance is not a reliable indicator of future results.

GOLD

Since 2020, gold has been held within a wide price consolidation range of $1600 to $2000 per ounce. With the potential end of the rate hike cycle in the US, the prospect of gold finally escaping this price pattern is on the horizon. A similar scenario was witnessed during the previous tightening cycle from 2015-2018, where gold remained within a range of $1050 to $1350. With the introduction of rate cuts, gold embarked on a clear upward trajectory. Could history repeat itself? Market expectations suggest that initial rate cuts could emerge as soon as mid-2024. Statistical data shows that the average increase in the price of gold over the two years following the last rate hike is near 20%. If this pattern were to repeat, gold could not only surpass its historical highs, but potentially reach levels nearing $2400. Additionally, gold typically experiences gains shortly before and after the anticipated first-rate cut in a cycle. However, the primary risk to this scenario is a potential return to rate hikes, which could lead to a resurgence of the dollar strength and a yield rally.

From a fundamental standpoint, the demand for gold has been relatively muted over the past year. However, a weaker dollar, coupled with a stronger Chinese yuan and Indian rupee, could change this situation. These countries are fundamental to the physical demand for gold. Moreover, with gold ETFs having ceased their selling activities, potential capital inflows into these funds could stimulate further demand for physical gold.

Chart: Average gold performance ahead and after the first Fed cut in a cycle.

OIL

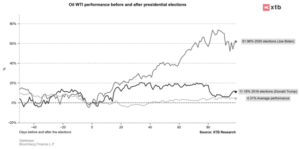

In 2023, the oil market managed to maintain relative stability, in spite of two production cuts implemented by OPEC+. The key question for 2024 is whether OPEC+ countries, particularly Saudi Arabia and Russia, will choose to restore a portion of their normal production, potentially resulting in a more balanced market. Nevertheless, the outlook for demand remains uncertain amongst market participants. Despite China’s rise to becoming the world’s leading oil importer, investors are unsure if the increased demand from China and India will be sufficient to catalyze a significant rebound in oil prices. Furthermore, OPEC+ countries, especially Saudi Arabia, may desire to keep prices within the bracket of $80-100 per barrel. In the face of weak demand, this could instigate further production cuts from oil major producers. Beyond the supply and demand dynamics, both the situation in the Middle East and the upcoming US elections introduce additional elements of uncertainty. On one hand, an intensification of regional conflicts could diminish the available supply in the market. On the other hand, US President Biden may aim to decrease or at least stabilize fuel prices, and may encourage his Arab allies to boost production to accomplish this objective.

Key Facts:

- Saudi Arabia has supplied the market with the least amount of oil and fuels since 2015.

- China imported over 18 million tons of oil and fuels in the first nine months of 2023, which was more than double the amount in the same period the previous year.

- Oil prices remained statistically flat ahead of the US presidential election, but experienced gains post-event.

TOP stocks

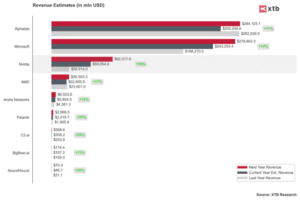

Key facts:

- Artificial intelligence was the main stock market trend of 2023

- Key to its sustainability in 2024 will be the companies’ ability to continue to grow

- Companies’ earnings forecasts point to significant revenue and EBITDA growth in the upcoming year

The first wave of euphoria around the rapidly growing AI industry is behind us. This does not mean, however, that in 2024 the topic of artificial intelligence will not linger on the tabloids of major media outlets. For us investors, however, the key question may be whether, in addition to the media spotlight seen in 2023 (which was also followed by an upturn in the valuations of companies in this industry), it will be followed by an increase in the financial performance of the companies that are most closely linked to this market.

It is worth bearing in mind that among the most recognizable AI companies, many of them are also listed as the largest companies in the US market. Looking at how Nvidia, Microsoft or Google may perform fundamentally next year can, in addition to providing insight concerning the artificial intelligence sphere itself, also provide us with a view of how Wall Street as a whole may perform.

Current earnings forecasts for 2024 point to further growth in the AI market. Representative companies are mostly expected to post sizable YoY growth in revenue as well as EBITDA, which could lay the groundwork for a second wave of optimism toward AI. Initially, AI was associated with a wave of speculation, but as the 2023 data and estimates for 2024 show, the industry is actually showing signs of sizable organic growth.

In this regard, it is worth looking at the companies that were/are struggling with profitability in 2023, but the next year is expected to change this situation. After years of losses and ‘cash burn’, technology company Palantir has had a year in which it achieved profitability for the first time in its history. The company has leapfrogged business agreements not only with the public sector but especially with the private sector in 2023, including Amazon Web Services, Oracle and Panasonic. Palantir can therefore look forward to two positive catalysts: the growing civilian sector and the development of AI products and services for defence and intelligence agencies, as geopolitics make its products needed more than ever. From the other hand, Palantir’s lack of a cloud-based recurring-subscription model remains a drag on predictability and limits visibility around management’s expectations for accelerating top-line growth.

Another innovative company that is not yet that known in the broad market, and the financial forecasts seem favourable for it, is SoundHound. The company’s goal is to develop AI-based music and voice recognition technologies and create tools to remotely assist employees with artificial intelligence. The company has struggled with a lack of profitability, which has been exacerbated by an environment of tight central bank policy, meaning that the cost of servicing debt has increased with limited external funding available. Next year, however, is expected to reverse this situation as the market is expected to begin a vigorous process of rate cuts. Lower debt servicing costs and the company’s projected revenue growth could negate the downward wave that company experienced in 2023.

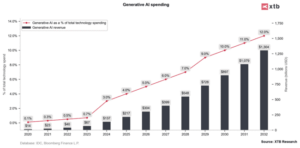

The macro outlook remains key. Generative AI is expected to grow exponentially, according to forecasts, and represent a key portion of companies’ investments in technology in the future.

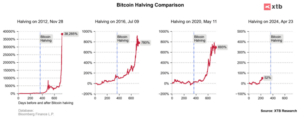

Bitcoin 2024 halving: Will history repeat?

Next year is highly anticipated for the crypto market, particularly due to the Bitcoin halving, which occurs every four years. The focus will also be on the U.S. Securities and Exchange Commission’s (SEC) decision regarding Bitcoin ETF applications from major Wall Street institutions. The key question is whether the current level of cryptocurrency adoption signifies a long-term foundational shift. In November 2023, Bitcoin daily transactions reached a record high of 710k, but only 235k were financial transactions, signifying a modest 10% annual growth. The number of active Bitcoin addresses has plateaued for over three years. Despite over 15 years since Bitcoin’s inception, its adoption curve is not parallel to the rapid rise of the internet or technologies like ChatGPT. However, factors such as migrations from crypto exchanges, bank failures, and new technological advancements in Bitcoin have spurred increased user activity. Yet, the transaction and adoption data do not solidly support the practical utility for all the 22,000+ cryptocurrencies in existence.

In late 2023, a $4.3 billion fine levied against Binance by the US Department of Justice and the legal proceedings against its founder, Changpeng Zhao, caused concern in the market but did not lead to widespread panic, signaling that investors do not expect another ‘FTX’ story. Despite this, it may be a signal that the trend of ‘moving out’ from crypto exchanges will persist, with unknown future effects for the entire crypto ecosystem. For now, cryptocurrencies are still more ‘anti-systemic’ and speculative assets than products with massive adoption. Financial institutions are recognizing the rising speculative demand and exploring ways to monetize it. The acceptance of Bitcoin ETFs may lead to both retail and institutional investors increasing their investment. Both SEC final deadlines (10 January and 15 March) and the estimated halving date on April 23 lead us to the conclusion that the first half of 2024 will be pivotal for crypto market dynamics.

- Visa processes approximately 597 million transactions daily, compared to approximately 1.9 million daily transactions on both the Ethereum and Bitcoin blockchains.

- The BlackRock iShares Ethereum Trust ETF could be a catalyst in the coming year, driving investors’ attention to the entire Ethereum ecosystem and smaller projects.

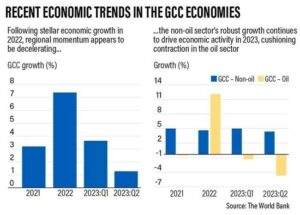

Local market ( GCC )

We and as few economic experts in the Gulf region agreed with the estimates recently announced by the World Bank regarding growth in the six Gulf countries, considering that there are many factors that will help the Gulf economy return to its rise during the next two years.

A World Bank report – issued a few days ago – indicated that the economies of the Gulf Cooperation Council region would grow by 1% in 2023, before rising again to record 3.6% and 3.7% in 2024 and 2025, respectively.

The bank attributed the weak economic performance this year to the decline in oil sector activities, which is expected to contract by 3.9%, in the wake of successive OPEC+ production cuts, in addition to the global economic slowdown.

Reasons for the decline

Analysts agree with the World Bank’s expectations regarding economic growth in the Gulf over the next two years, stressing that the decline during the current year is due to several reasons, the most important of which are:

- Oil production cuts.

- Significantly high interest rates.

- Uncertainty.

- The Chinese economy was affected by a decline in growth rates for the first time in 20 years.

The elimination of the reasons that led to the decline in 2023 will lead to recording better Gulf economic growth during the years 2024 and 2025, according to the following data:

- The rise in oil prices affects the Gulf economy directly and positively.

- Oil prices rose from 10% to 15% during these two years.

- Low interest rates.

- Low inflation in the Western economy in general.

- Increased demand for oil by about one million to 1.2 million barrels per day.

- Increase internal demand.

Diversify sources of income

Resorting to diversifying sources of income will greatly help in the growth of the Gulf economy. What is striking is Qatar’s trend – for example – to develop the tourism sector in conjunction with hosting the 2022 World Cup, and Saudi Arabia’s efforts to host the same tournament in 2034 and Expo 2030 (Riyadh) confirms that The Gulf path is moving towards diversifying sources of income.

The Gulf region enjoys many benefits that qualify its economies for growth, such as:

- Security stability that encourages internal and external investments.

- Oil components, as the Gulf region is considered among the richest regions in oil and natural gas resources.

- Developing infrastructure and providing modern transportation lines.

- Extreme flexibility in overcoming obstacles to the external investor and the availability of foreign ownership areas in many Gulf countries.

The GCC countries have a clear vision to diversify their economies, foremost of which is developing non-oil sectors, such as clean energy projects, communications and tourism.

There are huge projects in the field of alternative energy being implemented in Saudi Arabia, Oman, Qatar and UAE, most notably the “NEOM” green hydrogen plant in Saudi Arabia, which will produce 600 metric tons of carbon-free hydrogen by the end of 2023.

The region has witnessed a noticeable improvement in the performance of the non-oil sectors, despite the decline in oil production during most of the year 2023, and in addition to the efforts of economic diversification and the development of the non-oil sectors have contributed greatly to the creation of job opportunities in the various sectors and geographical regions. Within the Gulf Cooperation Council countries.

In the UAE, the country’s share of oil production within OPEC+ as of January will support growth in the oil sector.

At the same time, the non-oil economy is supported by a strong influx of tourists that exceeds pre-pandemic levels, but despite the number of visitors to Dubai reaching a record level, hotel occupancy rates declined this year and hotel revenue growth slowed.