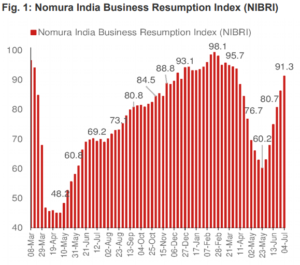

The Nomura India Business Resumption Index (NIBRI) picked up for a sixth consecutive week to 91.3 for the week ending 4 July from 86.3 the previous week; it is now only 8.7pp below pre-pandemic levels and 3.6pp below pre-second wave level.

•Mobility indicators like Google’s workplace and retail & recreation mobility indices increased by 3.1pp and 6.9pp, respectively, from the previous week, while the Apple driving index rose by 10.3pp. Power demand surged by 6.9% w-o-w (sa) after a 7.8% rise the previous week, while the labour participation rate inched down to 39.6%.

•The first flush of ‘conventional’ monthly data for June, like trade , GST E-way bills, and auto and diesel sales have improved sequentially from May levels, in line with our expectations , despite softer manufacturing and services PMIs and stagnant railway freight revenues.

•We expect a higher average vaccination pace in July than the ~3.8mn doses/day in June, due to improving supply, but the real pivot will likely take place in August, when we expect supply capacity to rise materially. Notwithstanding third-wave risks, the data so far support our view that the economic hit is likely to be localized to Q2, with GDP growth averaging an above-consensus 10.4% y-o-y in FY22 (year-end March 2022).