The 2026 Outlook for Global Stocks

BY GOLDMAN SACHS

| The key insights today: |

What’s next for oil after Venezuela? What’s next for oil after Venezuela?  A QuickPoll on the investor outlook for oil A QuickPoll on the investor outlook for oil  Global stocks are expected to generate double-digit returns in 2026 Global stocks are expected to generate double-digit returns in 2026  China’s economy is forecast to grow 4.8% this year China’s economy is forecast to grow 4.8% this year The Key Number: The tech sector’s capex in 2026 The Key Number: The tech sector’s capex in 2026  One River’s Eric Peters on the future of finance One River’s Eric Peters on the future of finance  Briefings Brainteaser: Japanese households’ stock investments Briefings Brainteaser: Japanese households’ stock investments |

Oil Market Impacts from Venezuela

The oil market’s reaction to Venezuela’s political upheaval has been relatively muted, but the impact on the country’s oil reserves—among the largest in the world—could still be significant, says Goldman Sachs Research’s Daan Struyven, co-head of global commodities research and head of oil research, in an episode of Goldman Sachs Exchanges.

- The key to unlocking Venezuela’s oil potential lies in incentives and guarantees for US investment, Struyven tells host Allison Nathan. Given the degraded state of Venezuela’s oil infrastructure, significant investment and a robust policy framework will be necessary to bring production back to higher levels.

- “Venezuelan oil is quite attractive from an underground perspective—from a geological perspective,” Struyven says. The biggest challenges are above the ground, he adds—the future tax rate, the state of infrastructure, and the risk of another wave of nationalization. “If we get the above-the-ground incentives in place, I think it will be quite plausible to argue that production will rise, because the underground geological setup is just quite attractive, » he says.

- Production could rise to 1.5 million barrels per day by 2030 in a bullish scenario, potentially doubling to 2 million barrels per day if major US oil producers invest heavily in the region, Struyven says.

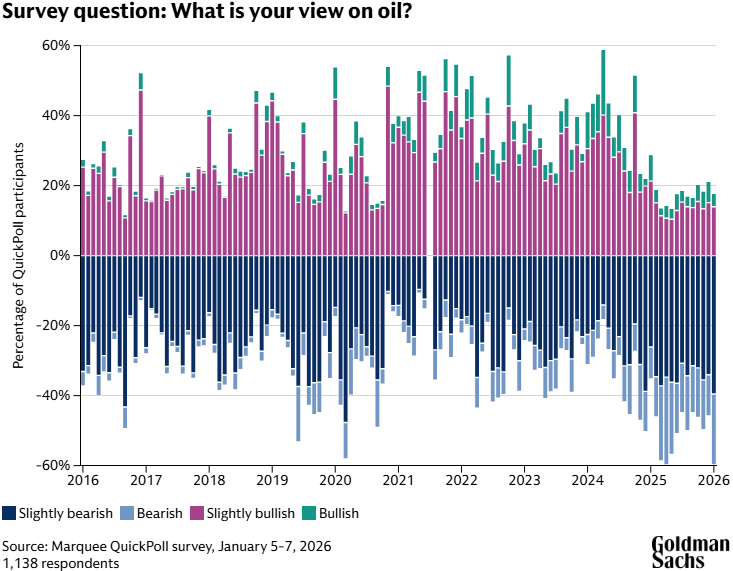

| Investors Are Getting More Bearish on Oil Amid Developments in Venezuela |

| According to a survey of Goldman Sachs clients conducted this week, investor bearishness on oil reached extremes in January. Over the past 10 years, this level of bearishness has only been observed once: just after the US Liberation Day tariff announcement on April 2, 2025. |

| Geopolitical developments are driving the broader sentiment, with 42% of investors saying geopolitics is the top risk they are watching this month (second only to US economic data at 49%), according to Goldman Sachs Marquee’s QuickPoll. Views on gold, however, were steady. In fact, conviction levels are strengthening, as 28% of respondents expect to buy precious metals versus only 14% who expect to cut or sell their positions. |

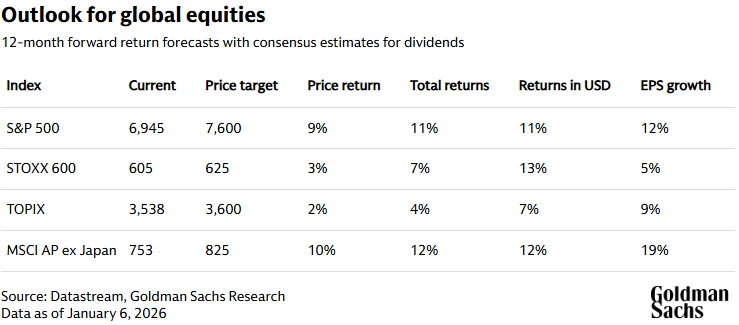

Global Stocks Are Projected to Return 11% Over Next 12 Months

Global stocks are expected to keep climbing in 2026 but not as strongly as last year, with diversification across styles, sectors, and regions potentially giving a boost to investors, according to Goldman Sachs Research.

The world economy is poised for continued expansion in 2026, and the US Federal Reserve is forecast to provide further modest easing.

“Given this macro backdrop, it would be unusual to see a significant equity setback/bear market without a recession, even from elevated valuations,” Peter Oppenheimer, Goldman Sachs Research’s chief global equity strategist, writes in a report titled “Global Equity Strategy 2026 Outlook: Tech Tonic—a Broadening Bull Market.”

- Our analysts’ 12-month global forecasts indicate equity prices, weighted by regional market cap, are expected to climb 9% this year and return 11% with dividends, in US dollar terms.

- The strong rally in global equities in 2025 has left valuations at historically high levels across all regions—not just in the US but also in Japan, Europe, and emerging markets. “Consequently, we think that returns in 2026 are likely to be driven more by fundamental profit growth rather than by rising valuations,” Oppenheimer says.

- Investors who diversified across regions were rewarded last year for the first time in many years, as the US underperformed most major markets. Our analysts expect diversification as a theme to continue in 2026, extending to investment factors such as growth and value and across sectors.

Read the full article on Goldman Sachs Research’s outlook for global stocks in 2026. Find all our outlooks for markets and the global economy here.

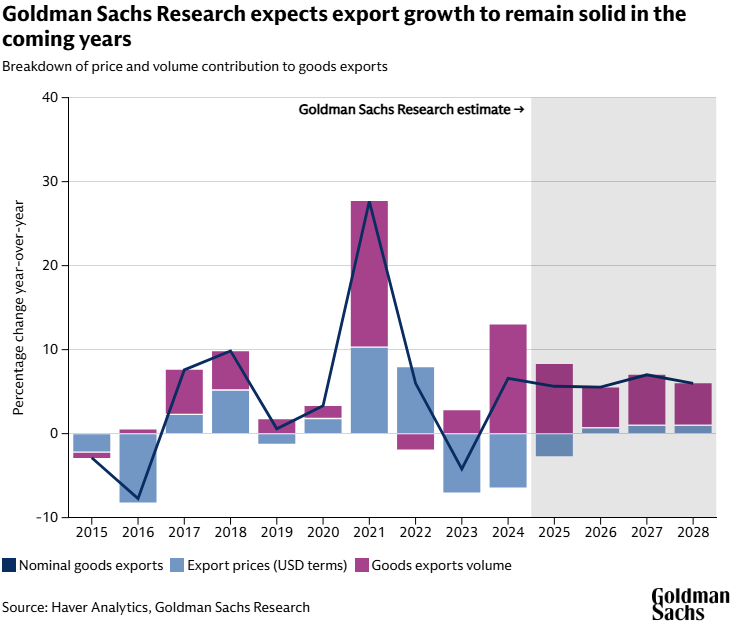

Strong Exports to Boost China’s Economy in 2026

Goldman Sachs Research forecasts that China’s real GDP will grow by 4.8% in 2026, above the consensus estimate of 4.5%. This projection is driven by resilient export volumes and less economic drag from the declining property market.

Although Chinese exporters have successfully diversified into non-US markets, policymakers will need to find new sources of growth in the coming years, writes Hui Shan, chief China economist in Goldman Sachs Research, in the team’s report. “Building a consumption- and services-driven economy will take years, if not decades,” she writes.

| The team’s most distinctive out-of-consensus view is for China’s current account surplus to rise to 4.2% of GDP in 2026 from 3.6% last year. The consensus of economists surveyed by Bloomberg is for it to decline to 2.5% of GDP. Our economists expect nominal export growth to remain solid in 2026 at 5.6% (versus 5.5% in 2025) in US dollar terms. Their estimate is underpinned by higher exports to emerging market economies, China’s dominance in critical minerals, and the potential for greater growth in high-tech exports. At the same time, China’s property sector is in its fifth year of decline. Goldman Sachs Research expects that the property sector’s drag on annual real GDP growth—around 2 percentage points per year in 2024 and 2025—will narrow by 0.5 percentage points per year over the next few years. Read the full article on the outlook for China’s economy in 2026. |